Related Categories

Related Articles

Articles

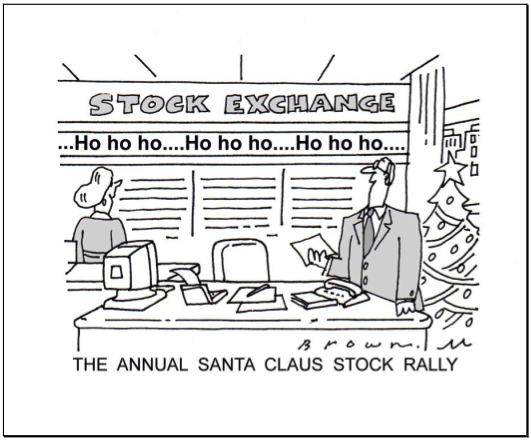

Last 2 months of the year / SANTA RALLY

Since the 31st Dec. 1945 the S&P 500 rallied in over 77% of the time in the final two months of the year to reach an average gain of 3% in that short period. These odds are pretty good i may say. To put this into perspective: If you were to invest every year in a 10year-period, you would gain in 7 years out of 10 (and in 3 years you may lose, if you only pick the index; If you are a good stock-picker you may be able to avoid a possible fall in the index/versus an ETF-Holder).

Since the 31st Dec. 1945 the S&P 500 rallied in over 77% of the time in the final two months of the year to reach an average gain of 3% in that short period. These odds are pretty good i may say. To put this into perspective: If you were to invest every year in a 10year-period, you would gain in 7 years out of 10 (and in 3 years you may lose, if you only pick the index; If you are a good stock-picker you may be able to avoid a possible fall in the index/versus an ETF-Holder).

As one may know from the articles I have posted in the past one can even try to pick the stocks out of the sectors of the S&P500, which tend to outperform the average stock market.

As mentioned in an article on the 29th Oct. 2015 on this site (please look up my posting from 29th Oct. 2015 under the section "Seasonality") the sectors which have the tendency to outperform the broad market => may be the Semiconductors, Technology, Telecom or Healthcare Providers. Internet, Utilities or Biotech can also be mentioned. If the 7/10-chance will really unfold we will only find out the latest on 31st Dec. 2015. (S&P500 Status as per 30th Oct. 2015 CET 12:20 @ ca. 2.092 poins)

see also: http://www.marketwatch.com