Related Categories

Related Articles

Articles

Seasonal Anomaly

(TOM-Effect)

Lakonishok and Smidt (1988) coined the phrase the "turn-of-the-month effect" to describe the unusually high returns earned by DJIA equities over the four-day interval beginning with the last trading day of the month and ending three days later. Their...

...study covered the years 1897–1986 (whereby DJIA stands for Dow Jones Industrial Average). John J. McConnell and Wei Xu found that the turn-of-the-month effect was pronounced in the two decades from 1987 - 2005 as well. So, when they combined their findings with those of Lakonishok and Smidt, the result is that for the 109-year period of 1897–2005, on average, all of the positive return to equities occurred during the turn-of-the-month interval. Thus, on average, over the other 16 trading days of the month, investors received no reward for bearing market risk.

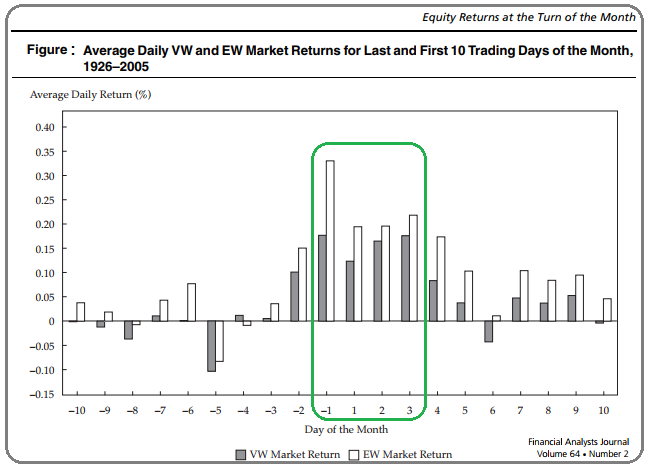

To conduct their analysis, J. McConnell and Wei Xu used CRSP valueweighted (VW) and equal-weighted (EW) market indices. The Figure above shows average stock market returns for the 1987-2005 period by day of the month for the VW and EW indices. Day -1 is the last trading day of the prior month, Day +1 is the first trading day of the month, Day +2 is the second trading day of the month, and so on.

The Figure shows that returns at the turn of the month during this period were unusually high relative to returns on other days! As one moves away from the turn of the month on the x-axis, average returns diminish; some days even have negative average returns. The unusually high returns at the turn of the month could be construed as beginning with Day –2. For consistency with prior studies, however, they consider the turn of the month as encompassing Day –1 through Day +3!

Regardless of when the turn of the month is determined to begin, daily returns are obviously not evenly distributed throughout the month and the turn of the month received an outsized portion of the equity returns during the 1987-2005 period.

The turn-of-the-month effect in equity returns continues to be a puzzle in search of a solution. Historically, seasonalities in asset returns have been labeled "anomalies." At some point, however, a persistent anomaly becomes the norm. The turnof-the-month effect in equity returns appears to have persisted for more than 100 years. Perhaps, it is the norm...

link / .pdf-download

www.cfapubs.org/doi/pdf