Related Categories

Related Articles

Articles

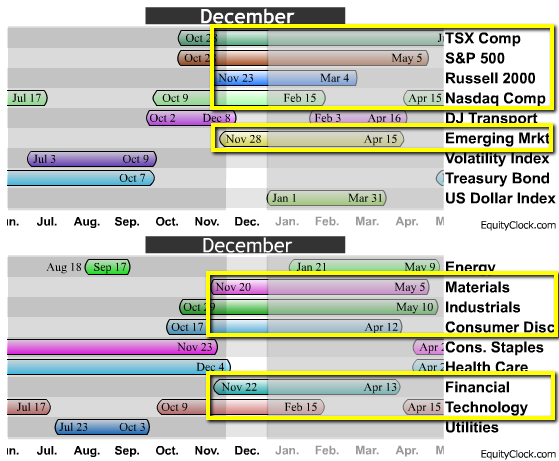

Seasonality Dec./Q1-2016 possibilites (?)

Seasonality refers to particular time frames when stocks/sectors/indices are subjected to and influenced by recurring tendencies that produce patterns that are apparent in the investment valuation. (source: www.equityclock.com)

Tendencies can range from weather events (temperature in winter vs. summer, probability of inclement conditions, etc.) to calendar events (quarterly reporting expectations, announcements, etc.). The key is that the tendency is recurring and provides a sustainable probability of performing in a manner consistent to previous results.

Identified above are the periods of seasonal strength for each market segment. Each indicates a buy and sell date based upon the optimal holding period for each market sector/index.

From a possible "priorities list" one can rank these indices/sectors as following:

-) Nasdaq Composite (up to 5th Feb.)

-) Technology (up to 15th Feb.)

-) Russel 2000/Small Caps (up to 4th March)

-) Consumer Discretionary (up to 12th April)

-) Financial (up to 13th April)

-) Emerging Markets (up to 15th April)

-) S&P500 (up to 5th May)

-) Materials (up to 5th May)

-) Industrials (up to 10th May)

-) TSX/Canada (up to June)