Related Categories

Related Articles

Articles

APPLE (Snapshot January 2016)

source: http://www.infinancials.com

source: http://www.infinancials.com

Apple-Stock-Valuation @ price per stock of 93.42 USD (27th Jan. 2016)

Market Cap: USD 517.97B*

Apple - Enterprise Value/EBITDA (ttm): 6.56*

Comparison/Group Computer Hardware - Enterprise Value/EBITDA (EV/EBITDA): 6.62*

S&P 500 - Median over 35 years! (historical calculation) EV/EBITDA: 8.2**

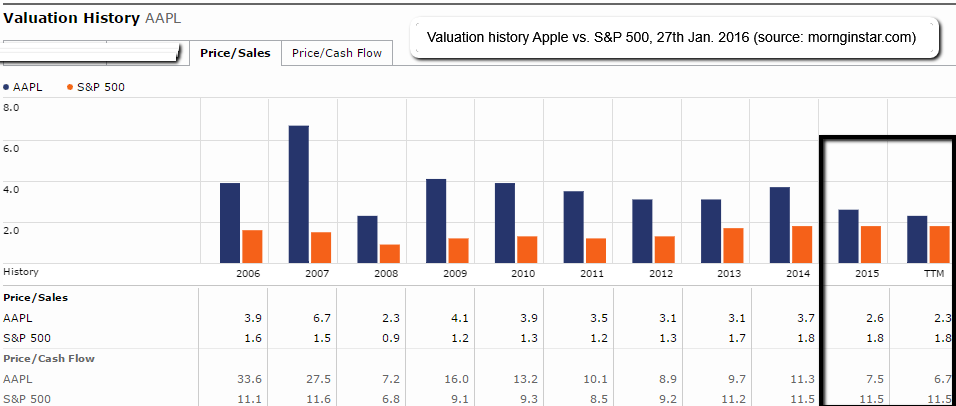

Apple - Price/Sales (ttm): 2.39*

S&P 500 - Price/Sales: 1.8*

Apple - Forward Annual Dividend Yield: 2.09% (Data provided by Morningstar, Inc.)

Apple - Dividend-Payout Ratio (payout/earnings): 21.48% (Data provided by Morningstar, Inc.)

* (Data provided by Capital IQ/finance.yahoo.com, morningstar.com, 27th Jan. 2016)

** (source: Compustat and Goldman Sachs Global Investment Research, Feb. 2015)

Putting together all the puzzle-parts and re-evaluating the Status-Quo for Apple, it seems the future of the company lies in the near-term success of the next-evolution launch of its main Cash-Flow-product: iPhone / the iPhone 7.

Especially the success in the Asian markets (China & India) will lead the future path for Apple. One should also not forget that the Apple-Watch already generated minor revenue. To put this into perspective: (my guess) over USD 3 billion so far/since product-launch...(see also: http://appleinsider.com)

The correction, especially in Q4-2015 and now in January 2016 lead to a current stock-price of ca. 93 USD. To stay as objective as possible I want to show a long-term chart (weekly) of the stock-evolution. Currently (Jan. 2016) the stock is hovering above its 200-weekly-Moving-Average and is below its year-2012-high.

One may get an ever better idea regarding momentum and the big-picture when looking at the "monthly-candlestick-chart":

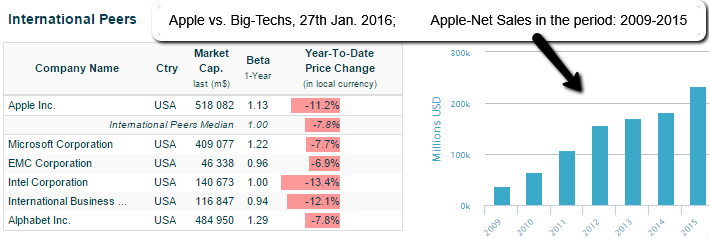

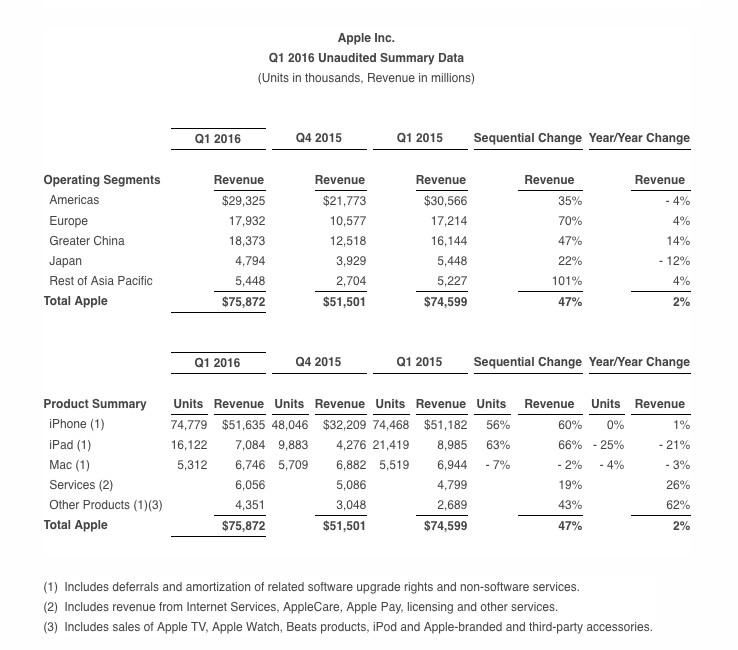

To wrap up the snapshot one should also take a look at the revenue-breakdown by region & product-segment as per the last quarterly earnings release on 26th Jan. 2016. Easy to understand then, why one should focus on the Asian markets (future growth) and the iPhone (short-term-driver):

source: http://www.idownloadblog.com

source: http://www.idownloadblog.com

Disclaimer:

Ralph Gollner hereby discloses that he does not directly owns securities of the stock (Apple) mentioned above (as per 28th January 2016).