Related Categories

Related Articles

Articles

Facebook (earnings review)

quick n dirty

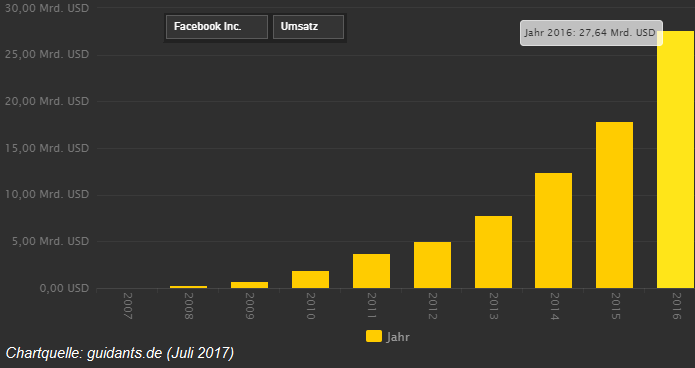

Let's check the latest metrics in the wake of Facebook’s robust Q2-2017 results on 26th July 2017. Its revenue increased to over USD 9 billion, up 45% versus a year ago - that is enormous growth for such a large company. But one concern is...

...that Facebook is basically already selling all the advertising space on your News Feed that it can, and so that growth may be difficult to sustain. However, it is far from fully monetizing Instagram, WhatsApp or Messenger - so there may still be plenty of low hanging fruit left.

Further metrics from FB: They announced "55% adjusted EBITDA growth, and 47% free cash flow growth" - pretty impressive for a company that is already delivering a USD 36 billion revenue for the last twelve months.

Another one: Facebook’s profit in its latest quarter rose 71% versus a year ago to beat Wall Street’s expectations once again. Encouragingly core FB is growing extremely well, with "almost unprecedented Ad Revenue growth consistency".

And this growth shows no signs of slowing down. Maybe even on the contrary: "Facebook currently might have a market share of approximately 15% of the Global Online Advertising-Market and 5% of Global Total Advertising - this should help it to maintain premium growth for an extended time", according to M. Mahaney, an Analyst with RBC Capital.

As you can see from the following chart, the stock of Facebook (ticker: FB) is sailing along and above its Long-Term-Moving-Averages and the stock shows no signs of abruptly stopping its ride...

p.s. Always "watch out" for a BLACK SWAN...

Disclaimer: Ralph Gollner hereby discloses that he directly owns securities of Facebook (FB), as per 31st July 2017.

Disclaimer/Hinweis nach §34 WPHG zur Begründung möglicher Interessenkonflikte: Aktien von Facebook (FB) befinden sich aktuell im "Echt-Depot" von Mag. Ralph Gollner - per 31. Juli 2017.