Related Categories

Related Articles

Articles

Mastercard (Ticker: MA)

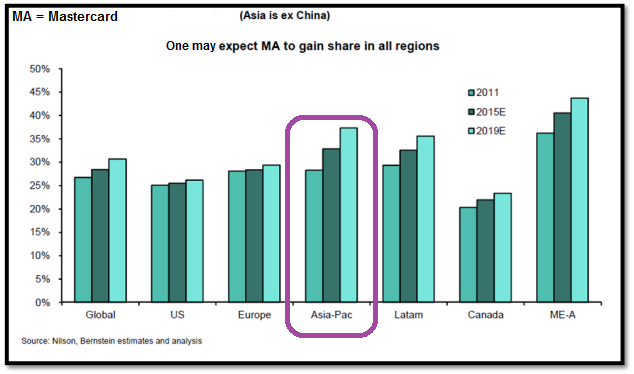

Driven by global economic growth and a secular shift to electronic payments, one can believe Mastercard (ticker: MA) can grow net revenue by low double digits over the next several years. This, coupled with modest margin expansion and aggressive share buyback...

...may result in earnings-per-share growth in the mid-to-high-teens. Still, this favorable outlook is reflected in Mastercard's valuation and therefore shares could only perform as per market averages.

The recent development in the last years obviously underlines the tailwind-forces, which are driving the Credit Card business and the stock-price of one of its most prominent players, being Mastercard (rising earnings, rising dividends, see below):

Disclaimer: Ralph Gollner hereby discloses that he directly owns securities of the stock Mastercard (MA) mentioned above (as per 13th June 2017).

Disclaimer/Hinweis nach §34 WPHG zur Begründung möglicher Interessenkonflikte: Die Aktie Mastercard, die in diesem Blogeintrag/Artikel behandelt/genannt wird, befindet sich aktuell (per 13. Juni 2017) im "Echt-Depot" von Mag. Ralph Gollner.

link: