Related Categories

Related Articles

Articles

The US 2-year/10-year spread

The US 2-year/10-year spread

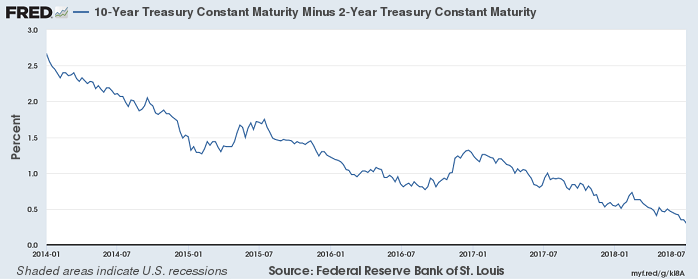

The 2-year/10-year spread, which measures the difference between short- and long-term bond yields, fell to 30 basis points as of Tuesday (3rd July 2018). That's the narrowest spread since...

...October 2007, a few months before the Great Recession. A flattening yield curve happens when the difference between short- and long-term bond yields narrows.

An inverted curve could signal a recession

The yield curve is considered inverted when short-term yields are trading higher than long-term yields, meaning investors expect returns to depreciate in the long run. REMINDER: Historically, that phenomenon doesn't play out well. An inverted yield curve has preceded every recession in the past 60 years!