Related Categories

Related Articles

Articles

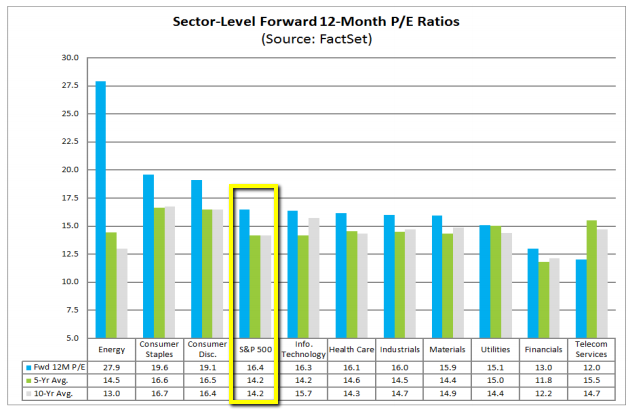

S&P 500 Index (Sectors), Fwd. PE-Valuation (27th Nov. 2015)

data as per 27th Nov. 2015

As Benjamin Graham writes in his book "Intelligent Investor" he recommends stocks whith a PE-Valuation not higer than 15, but the denominator NOT being the FORWARD-Earnings (Fwd-PE-Ratio), but calculated by the average earnings of the last 3 years!

One also has to see his initial approach for stock-picking through his year-1914ff-lenses. Benjamin Graham started his investing carreer after the 1914-years, a time-period, when recessions were more common than sustainable economic growth-cyles. Still, this approach would have definitely saved some stock investors from "hard landings" in the past decade or so (years 2000 - 2014).

Furthermore, of course, he always used to emphasise the importance of the Book-Value-indication. Here it is also important to know, that his initial recommendation was to stick to companies, which carry a Price-Book-Valuation (PBV) of max. 1.5. But as intangible assets like franchising-contracts, brand-names, patents, etc. are NOW versus THEN more and more part of the companies assets-side (not incl. in the book-value-parts) most companies now carry a higher Price-Book-Value than during B. Grahams' times.

Concluding one can currently still count over 130 companies in the broad S&P 500 which have a PBV BELOW 2 as per 27th Nov. 2015 (data-source: finviz.com).