Related Categories

Related Articles

Articles

S&P 500 (Pros YE-Targets 2017, EPS-estimates)

Status: Dec. 2016

Every September and December, Barron’s surveys a group of prominent strategists at major investment banks and money-management firms to gauge their outlook for stocks, bonds, and the economy in the months and year ahead.

Collectively, the strategists' mean expectation for the Standard & Poor's 500 puts the index at 2,380 by the end of next year, up about 5% from last week’s 2,258. In years past, top forecasters often called for a market gain of up to 10%, but the second-longest bull market ever is getting on in years, and besides, it has rallied furiously in the past five weeks (Nov. 2016 and Dec. 2016).

Collectively, the strategists' mean expectation for the Standard & Poor's 500 puts the index at 2,380 by the end of next year, up about 5% from last week’s 2,258. In years past, top forecasters often called for a market gain of up to 10%, but the second-longest bull market ever is getting on in years, and besides, it has rallied furiously in the past five weeks (Nov. 2016 and Dec. 2016).

Several strategists expect the S&P 500 to end next year at 2,300, the bottom of the group's range. John Praveen, chief investment strategist at Prudential International Investment Advisors, has a target of 2,575. In the past five years, Praveen consistently has been among the most bullish of our panelists, a stance that has been rewarded much of the time.

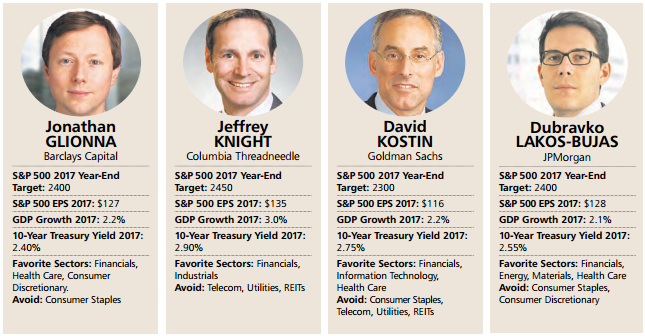

The prognosticators forecast aggregate growth in S&P 500 earnings of about 7% next year, to USD 127 from an expected USD 118.75 in 2016. In most cases, the 2017 number doesn't include the majority of Trump's proposed reforms. Instead, it reflects incremental earnings gains plus a sharp rebound in energy-company profits, now that oil prices have nearly doubled from their February low. The Trump agenda, in force, could add USD 5 to USD 10 to S&P earnings, the strategists say. Industry analysts are forecasting 2017 earnings of USD 132.69, a 12% increase over this year.

In the two overviews above I left out Mr. S. Auth (Federated Investors) and T. Levkovich (Citi Research), also since both gentlemen have a similar target-levels for YE-2017 for the S&P 500 (ca. 2,325 - 2,350 points). Their EPS-Estimates for 2017 are ca. USD 129 - USD 130 therefore also not for away from the other pundits.

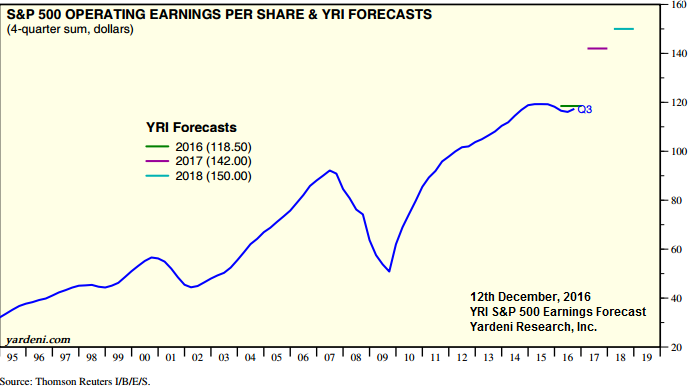

Finally I also want to mention the most recent EPS-updates from Mr. Ed Yardeni of Yardeni Research:

He raised his estimates in the light of lower taxes, etc. for the year 2017 up from USD 129 Dollar to now 142 Dollar. This is a new target, which is ca. USD 10 above the consensus:

Following that forecast he also lifts the prognosis for 2018 from USD 136.75 up to an EPS-level of USD 150 for the S&P 500! ...my comment: wOO-Haa :-)