Related Categories

Related Articles

Articles

Fed Rate Increase: Will this Hurt Stocks in the medium-term?

The Fed initiated the first rate hike today (16th Dec. 2015). There are some good reasons, why one should not be too fearful as equity-investor, please read some bullet points below (adapted):

source: http://mitchzacks.tumblr.com

source: http://mitchzacks.tumblr.com

1. The Market Already Knows – Fed rate hike timing has been one of the most widely discussed economic topics in the last two years, and at no point has Janet Yellen dealt us a shocking shift in her thinking for policy setting. The Fed is more transparent than ever - providing market guidance for interest rate policy and, as such, plenty of information to price-in the effect of rate hikes. A good rule of thumb with investing is - if everyone is talking about a hot topic, it probably won’t have much impact.

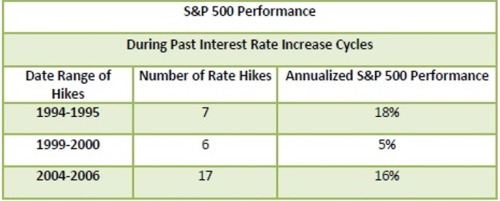

2. Stocks Have Done Well During Rate Hike Cycles - if you look back at the last three stretches of Fed interest rate increases, stocks actually performed quite well: It makes sense why the market would do well during tightening cycles – the Fed typically raises rates when the economy has underlying health and strength, which means growth is good and corporations are in a position to expand earnings. All positive forces for stocks.

3. The Pace of Rate Hikes Should be Gradual

Janet Yellen was spot-on to repeat, that gradual increases should give the market and economy time to adjust.

full article: http://mitchzacks.tumblr.com