Related Categories

Related Articles

Articles

The 200d Simple Moving Average (SMA)

"3 (or even 4) Standard Deviations above/below the SMA200-daily"

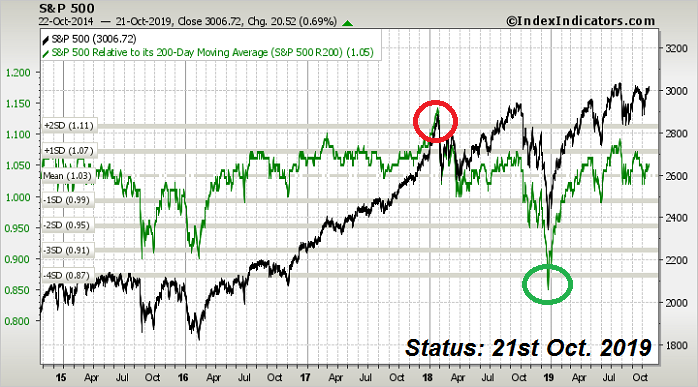

Upfront: Some days ago the S&P 500 reached a psychological level, which was near to its 200-Day Moving Average (SMA-200). So currently the "Mean" of that moving average is not far away:

But also the EMA 200 on a weekly basis can serve as a relevant and potential support line for Longterm-Investors.

automatically updated (!) Chart above

(S&P 500 on a weekly basis)

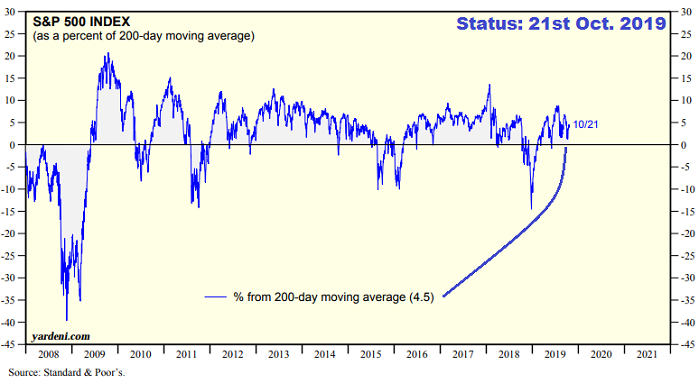

Back to the famous SME-200 (daily):

The 200 simple moving average (SMA) is considered a key indicator by traders and market analysts for determining the overall long-term trend. The price level in a market that coincides with the 200 SMA is -as history has proven several times- recognised as a major support when the price is above the 200 SMA or resistance when the price/Index is below the 200 SMA level.

The 200 SMA is particularly popular for application to daily charts. The 200-day SMA, which covers the previous 40 weeks of trading, is commonly used in stock trading to determine the general market trend. As long as a stock's price remains above the 200 SMA on the daily time frame, the stock is generally considered to be in an overall uptrend.

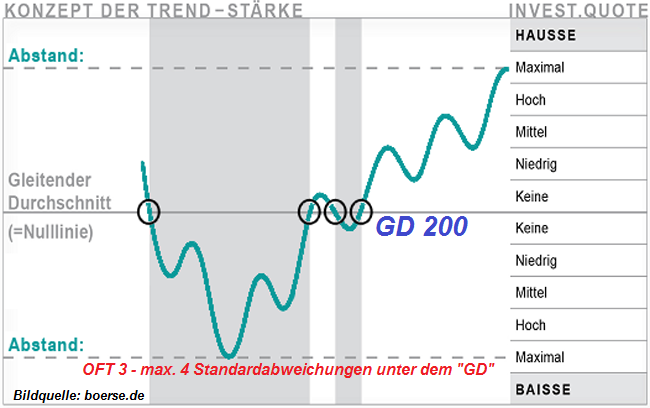

For the GERMAN Readers:

(selbsterklärend, aka "The Trend is your friend", OR "Don't fight a downtrend")

As a very long-term moving average, the 200 SMA is often used in conjunction with other, shorter-term moving averages to show not only the market trend but also to assess the strength of the trend as indicated by the separation between moving average lines. When moving average lines converge, this indicates a lack of definitive market momentum, whereas increasing separation between shorter-term moving averages and longer-term moving averages such as the 200 SMA indicates increasing trend strength and market momentum.

Currently (as per 21st October 2019) the S&P 500 lies ca. 4% above its 200day-Moving Average, therefore trying to pick up some Upward-Momentum. We will have to see and wait, until the Index can push itself over the 3k-level with some more power!

Golden Cross

The 200 SMA is considered so critically important that the event of the 50-day SMA crossing to the upside of the 200-day SMA is referred to as a "golden cross" signaling a (potential) bull market in a stock, index or other investment. In like fashion, the 50-day SMA crossing to the downside of the 200-day SMA is called a "death cross". An automatically updated Chart of the famous Dow Jones Industrial Average should give you an idea of how the Golden Cross is behaving in practice:

Conclusion

There might be some self-fulfilling prophecy aspect to the 200 SMA; Markets react strongly in relation to it partially just because so many traders and analysts attach so much importance to it...

Link:

https://www.investopedia.com/ask/answers

additional gimmick (timely ;-)

www.marketwatch.com/story/bull-trend-intact