Related Categories

Related Articles

Articles

(Historical) Stock Market Returns

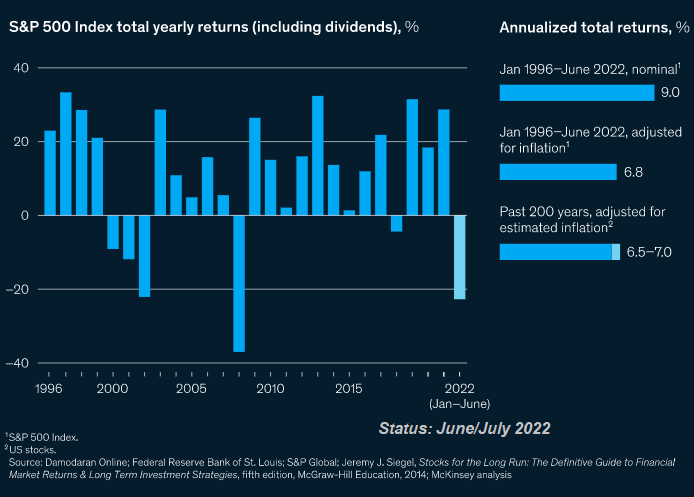

Many might be surprised to learn, however, that since about 1800, stocks have consistently returned an average of 6.5 to 7.0 percent per year (after inflation). In 2001, the market capitalization of...

...the companies that made up the S&P 500 was about USD 10 trillion. As of mid-June 2022 (even after a bearish opening to the year), the S&P 500 market capitalization was about USD 32 trillion.

The mean total yearly returns (including dividends) of the S&P 500 from the year 1996 to mid-June 2022 is + 9 % in nominal terms, or 6.8 percent in real terms - in line with historical results.

There were fluctuations, of course. The S&P 500 declined in 2000, 2001, and 2002, followed by a 37 % fall in 2008 and a 22 % fall in the first half of 2022. But from 1996 to mid-June 2022, S&P 500 returns declined annually only five times.

The lesson for investors?

Don't get sidetracked by short-term stock movements, which tend to stir up lots of headlines.

URL:

https://www.mckinsey.com/business-functions/strategy-and-corporate-finance