Related Categories

Related Articles

Articles

(HIGH) Inflation & the US-Stock Market

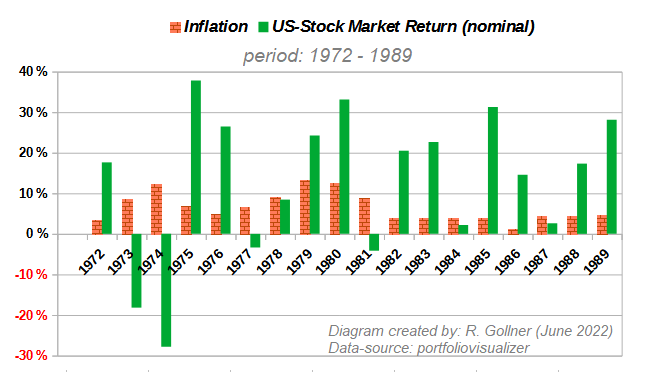

Let's recheck how the Stock Market did in the high-Inflation era (mainly) of the 70s. To begin with, the historical data provided by portfoliovisualizer showed an average inflation number of ca. 9.2% from the years...

...1973 until 1981. In these years, it seemed, that the shock of higher inflation figures than 4% hit the market wiht all its might in 1973 and 1974 first. Following those years, the market had seemed to digest higher inflation figures.

Please keep in mind:

In this respect I would also like to highlight, that the weighting of Oil, Energy & Commodity-related stocks was much higher than today - so you cannot compare the stockmarkt 1 on 1 with the current stock-market - composition!

Fascinating fact:

On average the stock market managed to gain +16.4% per year from the year 1975 onwards until the year 1981! Eventually the year 1981 marked the last year in the row with an inflation-reading above 8% (inflation of 8.92% in that year). Accounting for inflation the stock market return in the period 1975 until 1981 was still positive with +6.94% per year.

Let's see how this current decade of the 20s will evolve just now with the current high inflation data - not only in the US but - worldwide! Concluding one might make the remark, that stocks might really manage to serve as an inflation hedge over a longer timeframe of 10 years+