Related Categories

Related Articles

Articles

Choosing the "best" Benchmark

S&P 600 maybe?

An ETF on the S&P SmallCap 600 provides diversified exposure to U.S. small-cap stocks. The S&P SmallCap 600 Index is well diversified by sector and security with the highest exposure to financials, industrials and information technology.

Although the index covers 600 stocks, they only represent 3% of the U.S. equity market. Consequently, small-caps can constitute a small portion of a passive investor's portfolio. U.S. small caps have historically provided some diversification benefits. The S&P SmallCap 600 Index had a correlation of about 0.89 with the S&P 500 Index during the 5 year-period until 2015. Historically, small-caps have been more risky and sensitive to macroeconomic trends. The SmallCap 600, the S&P 500 and the S&P 400, together make up the S&P Composite 1500. As a result, adding funds that track these indices will not overlap portfolio holdings.

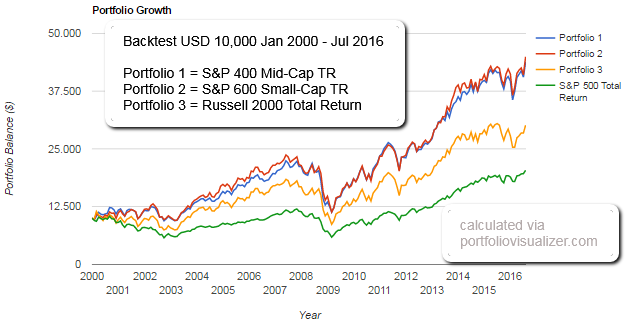

Investing in small-cap companies is a widely used strategy. Small-caps are public companies that are less established, less liquid and consequently, more risky than their large-cap counterparts. As financial theory echoes, higher risks reap higher rewards. Since 1926, small-cap stocks have earned a return premium of about 2% over large-caps, but this difference has been widely varied, leading and lagging, depending on the decade analysed. In the 1960s, small-cap stocks outpaced their large-cap brothers. This has also been the case since the early 2000s. From the 1980s until the 1990s, the situation reversed and large-caps led the way. Small-cap companies are also more sensitive to the economic cycle, outperforming large-caps during expansionary periods, but underperforming during contractionary ones when liquidity dries up and investors become more risk averse. Since the lows of 2009, the S&P SmallCap 600 beat the S&P 500 by over 50% (Status: 2015/2016). Companies gained easier access to debt financing at the same time as encouraged investors started to buy riskier assets. The sectors driving this success were consumer staples, consumer discretionary and health care with the largest drag coming from energy.

Although investing in a small-cap stock on its own may be risky, an entire portfolio of them disperses this risk among constituents. It also increases the probability of picking up the next Google or Facebook at a bargain. Notably, the 10 year annualised risk for the SmallCap 600 Index is approximately 19.03%, slightly higher than 14.90% for the S&P 500 (Status: 2015).

Prerequesite for each component:

The S&P SmallCap 600 Index is a free float capitalisation-weighted portfolio of 600 small-cap, United States domiciled stocks. For a constituent to be included in the index it must meet the following eligibility criteria; an unadjusted market cap of USD 400 million to USD 1.8 billion, a trading volume of at least 50% of its shares outstanding, a positive sum of the most recent as-reported earnings for four consecutive quarters, as well as for the most recent quarter. The U.S. Index Committee maintains the S&P SmallCap 600 and meets on a monthly basis. It aims to minimize index membership turnover. If a constituent no longer meets the entrance requirements, the committee will not remove the member immediately if they deem the change temporary. The most significant sector exposures are financials (22-25%), industrials (16-18%) and information technology (15-17%). Portfolio concentration is extremely limited, with the top ten holdings in the index making up less than 6% of its total.

links: