Related Categories

Related Articles

Articles

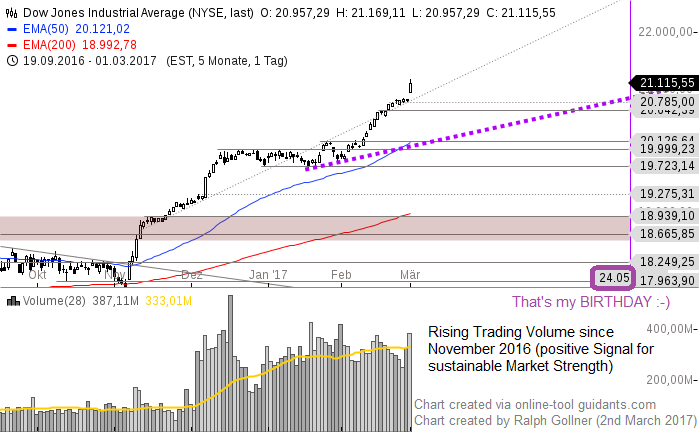

Rising Trading Volume (US-Stock Markets)

Dow Jones, S&P 500

UNTIL Oct. 2016 the US-stock market has been marked by declining trading volumes in the last years. The trading volumes story is a somewhat complex. Some argued that it was a sign of "low confirmation," meaning investors didn't...

...have a lot of conviction in their purchases as reflected by small bets.

But since Nov./Dec. 2016 these arguments are not relevant anymore, the trading volume seems to support the strong uplift across nearly all stock markets. It still needs to be analysed in detail if money is flowing from low-return Bonds into stocks, which -according to theory and empirical history- should deliver an equity premium...

Until 24th May 2017 (my birthday :-) I am trying to see, how the Dow Jones Industrial Average will move between 18.939 points (MY Worst Case Scenario, if NO 1987-CRASH is appearing) and 22,500 points...

BEFORE the YEAR 2016:

Daily updated S&P 500 Chart (check out the SMA200-line! "fascinating support")

Crazy VOLUME-SPIKE since Nov./Dec. 2016

Good luck & don't forget: Always Think Long-Term

link from the year 2015:

www.businessinsider.com/trading-volumes