Related Categories

Related Articles

Articles

Tail Risks

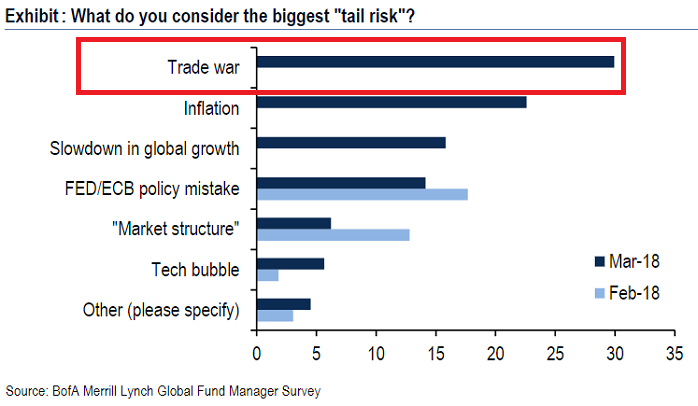

A "trade war" is the top tail risk for financial markets, according to fund managers, who also now overwhelmingly describe the global economy as entering the "late cycle" period. "Cracks in the bull case are starting to emerge, with fund managers citing concerns...

...over trade, stagflation and leverage," said Michael Hartnett, chief investment strategist at Bank of America Merrill Lynch, referring to the firm's monthly global fund managers survey released on Tuesday.

"Investors have yet to act on these fears, however, as rates and earnings are keeping the bulls bullish," he said.

Trade war moved into the top spot after U.S. President Donald Trump earlier this month imposed tariffs on aluminum and steel imports and as the administration signaled further trade measures were in the offing, underlining worries over a potential tit-for-tat spiral of retaliation that could pose a threat to global growth. Trade-war fears last topped the list in January 2017 ahead of Trump's inauguration.

The survey was conducted between 9th - 15th March 2018 and included 176 participants, with a combined USD 514 billion in assets under management.

In other findings, the poll found that 74% of investors believe the global economy is in the late cycle, the highest percentage in survey history.

The survey, however, showed that despite qualms, investors remained long global stocks, banks and tech, while remaining short bonds and defensives, while cash levels fell from 4.7% to 4.6%.

Meanwhile, subdued interest rates and strong earnings continued to encourage bulls, the survey found, with most expecting it to take a significant rise in Treasury yields to prompt a rotation out of stocks. When asked what 10-year Treasury yield level would incite rotation from stocks to bonds, the survey produced a weighted-midpoint of 3.6%. The 10-year yield was up 3.2 basis points Tuesday (20th March 2018) at 2.875%.

Meanwhile, fund managers said long bets on FAANG+BAT remained the "most crowded" trade. The acronyms refer to a combo of U.S. and Chinese tech juggernauts, with FAANG consisting of Facebook Inc. (FB), Amazon.com Inc. (AMZN), Apple Inc. (AAPL), Netflix Inc. (NFLX), and Google parent Alphabet Inc. (GOOG), BAT refers to Baidu Inc. (BIDU), Alibaba Group Holding (BABA), and Tencent Holdings Ltd (TCEHY).

Disclosure/Disclaimer: Ralph Gollner hereby discloses that he directly owns securities of the companies mentioned in the article: Facebook Inc. (FB), Amazon.com Inc. (AMZN), Apple Inc. (AAPL), Google parent Alphabet Inc. (GOOG), Alibaba, Baidu and Tencent as per 21st March 2018.

Disclaimer/Hinweis nach §34 WPHG zur Begründung möglicher Interessenkonflikte: Aktien von Alibaba, Baidu, Facebook, Apple, Google/Alphabet, Amazon und Tencent welche im Artikel erwähnt wurden, befinden sich aktuell im "Echt-Depot" von Mag. Ralph Gollner - per 21. März 2018.