Related Categories

Related Articles

Articles

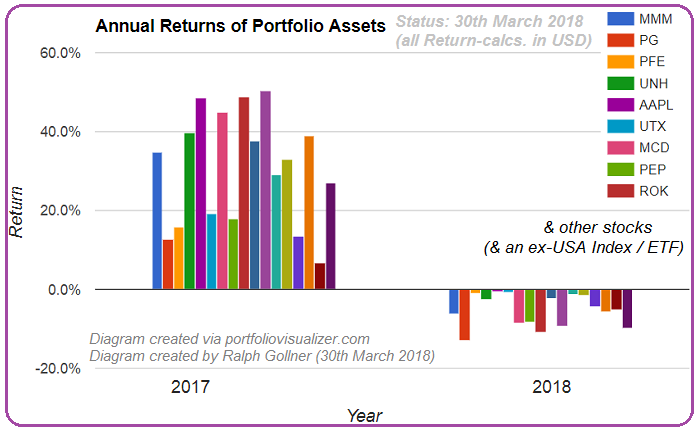

What goes up (2017), can come down (Q1-2018)

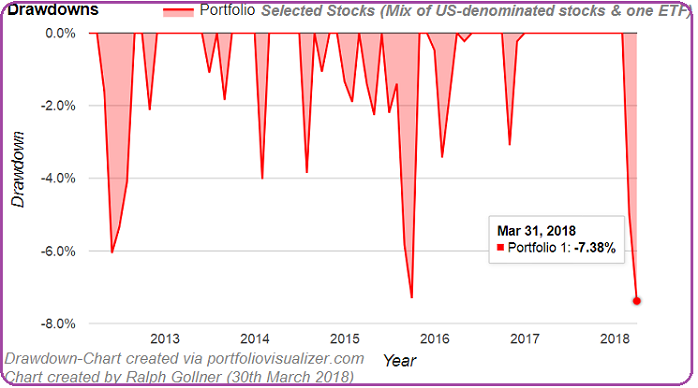

Just a small selection of stocks, which had a nice performance in the previous year (2017). Furthermore I selected those, which registered a negative start in Q1-2018. We will eventually see, what the historical drawdown periods of...

...the stock-basket may help finding a potential support for an "intrayear-fall/Maximum-Drawdown" in the year 2018. If the Efficient-Market-Hypothesis may tell us something, then maybe (at least) that a fair value can be found within a relative reliable round of best guesses of minus/plus 15%. If the stocks should fall through (as a basket) a threshold of more than 16%, then we could even challenge the thesis of a semi-strong EMH...

Back to practice: Another Risk-Buffer might (always) be - to enlarge ones Investment-Horizon from 5 years up to 9 years, etc.

Disclosure/Disclaimer: Ralph Gollner hereby discloses that he directly owns securities of the companies mentioned in the article: 3M, Procter & Gamble, Pfizer, United Health, Apple, United Technologies, Mc Donald's, Pepsi and Rockwell Automation as per 30th March 2018.

Disclaimer/Hinweis nach §34 WPHG zur Begründung möglicher Interessenkonflikte: Aktien von 3M, Procter & Gamble, Pfizer, United Health, Apple, United Technologies, Mc Donald's, Pepsi und Rockwell Automation, welche im Artikel erwähnt wurden, befinden sich aktuell im "Echt-Depot" von Mag. Ralph Gollner - per 30. März 2018.