Related Categories

Related Articles

Articles

(possible) Definition of Risk

in the Investment process (short remarks by Mr. Warren Buffet, made in the year 1994)

QUESTION

on how to define risk?

ANSWER by

Warren Buffett: Well, we do define risk as the possibility of harm or injury. And in that respect we think it's...

...inextricably wound up in your time horizon for holding an asset. I mean, if your risk is that you're going - if you intend to buy XYZ Corporation at 11:30 this morning and sell it out before the close today, that is a very risky transaction. Because we think 50% of the time you're going to suffer some harm or injury.

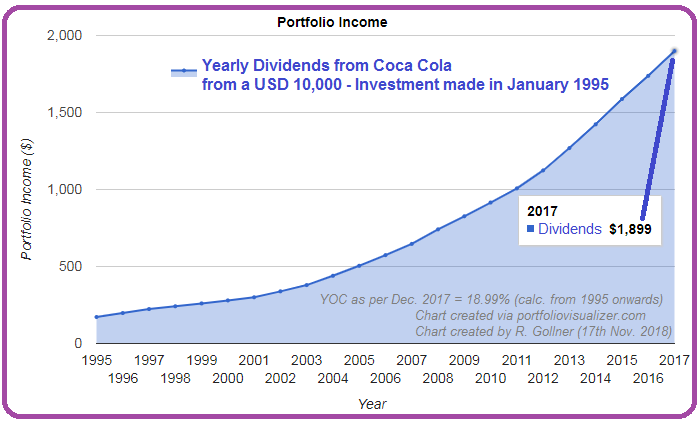

If you have a time horizon on business, we think the risk of buying something like Coca-Cola at the price we bought it a few years ago is essentially, is close to nil, in terms of our perspective holding period. But if you asked me the risk of buying Coca-Cola this morning (reminder from me, Ralph Gollner: this was in the year 1994 !!) and you're going to sell it tomorrow morning, I say that is a very risky transaction. Now, as I pointed out in the annual report, it became very fashionable in the academic world, and then that spilled over into the financial markets, to define risk in terms of volatility, of which beta became a measure. But that is no measure of risk to us.

The risk, in terms of our super-cat business, is not that we lose money in any given year. We know we’re going to lose money in some given day. That is for certain. And we’re extremely likely to lose money in a given year. Our time horizon of writing that business, you know, would be at least a decade. And we think the probability of losing money over a decade is low. So we feel that, in terms of ourhorizon of investment, that that is not a risky business.

And it's a whole lot less risky than writing something that's much more predictable. Interesting thing is that using conventional measures of risk, something whose return varies from year to year between plus-20% and plus-80% is riskier, as defined, than something whose return is 5% a year every year. We just think the financial world has gone haywire in terms of measures of risk. We look at what we do - we are perfectly willing to lose money on a given transaction, arbitrage being an example, any given insurance policy being another example. We are perfectly willing to lose money on any given transaction. We are not willing to enter into transactions in which we think the probability of doing a number of mutually independent events, but of a similar type, has an expectancy of loss. And we hope that we are entering into our transactions where our calculations of those probabilities have validity. And to do so, we try to narrow it down.

There are a whole bunch of things we just won't do because we don't think we can write the equation on them. But we, basically, Charlie and I by nature are pretty risk-averse. But we are very willing to enter into transactions - we, if we knew it was an honest coin, and someone wanted to give us seven-to-five or something of the sort on one flip, how much of Berkshire’s net worth would we put on that flip? Well we would - it would sound like a big number to you. It would not be a huge percentage of the net worth, but it would be a significant number. We will do things when probabilities favor us. (On this one Warren Buffet turns to Charlie: "Charlie?") >>

Charlie Munger (quote): "Yeah, we, I would say we try and think like Fermat and Pascal as if they'd never heard of modern finance theory. I really think that a lot of modern finance theory can only be described as disgusting."

Source: Taken from Berkshire's 1994 Annual Meeting Transcripts Notes