Related Categories

Related Articles

Articles

Be careful in your "1st years"

According to the U.S. market research group Dalbar, which publishes the Quantitative Analysis of Investor Behavior study, the Standard & Poor's has managed an annualized return of over 10% over the past 30 years,...

...far outstripping inflation, which has averaged ca. 2.7%. Over the same period, the average investor has achieved a return of 3.79% [...]. These figures are shocking as they show the average investor only achieved an average real annual return of 1.1% per annum over the past three decades.

...far outstripping inflation, which has averaged ca. 2.7%. Over the same period, the average investor has achieved a return of 3.79% [...]. These figures are shocking as they show the average investor only achieved an average real annual return of 1.1% per annum over the past three decades.

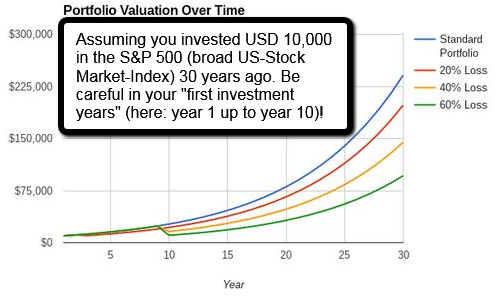

For the purpose of this article, however, we only need the returns figures. Assuming you invested USD 10,000 in the S&P 500 30 years ago, today after growing at a rate of over 10% per annum for three decades that amount would be worth just over USD 241,000. But all it would take is one significant loss in the first or second year (when you’ve first started investing) to severely impact long-term returns.

Example: Let's say you’re running a portfolio of 30 stocks, which are producing the same annual returns as the S&P 500. In year two, one of the positions goes to zero, giving a 3.3% loss overall or USD 370 of the portfolio at the time.

At the end of the three decades, your total portfolio value stands at USD 234,000 after this adjustment, a cost of USD 7,000. Clearly, this back-of-the-envelope calculation does not reflect the whole picture; there are other things to consider here, but it does highlight a key point.

A 20% loss in year two would leave you with only USD 198,000 at the end of the three-decade period, USD 43,000 less than value would have been if the investor had followed Buffett’s first two rules. Further losses of 40% and 60% in year 10 are reflected in the chart above.

The bottom line

Overall, it’s crucial that investors understand and implement the ideas behind Buffett’s first two rule sof investing. A significant investment loss can hold back your returns for decades but by remembering Buffett's rules, you should be able to avoid this disastrous scenario. (p.s. Do you know/remember the first 2 rules of investing?)

complete original article: www.gurufocus.com/news/435088/buffetts-first-2-rules-can-make-or-break-your-performance