Related Categories

Related Articles

Articles

Timing the stock-investments

(Mag. R. Gollner)

A Buy & Hold Portfolio may give you some nice outperformance. But when using an adaptive approach - therefore varying the stock-investment-ratio in the portfolio you could avoid potentially disastrous downmoves like the one...

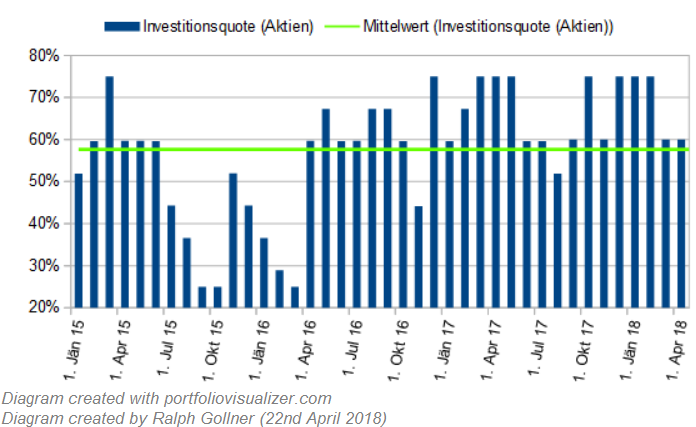

...experienced in the year 2008, 2009. The variation of the investment-level (percentage stocks-investment level) is mainly driven by a momentum-intensity check (on a monthly basis).

From Jan. 2015 up to March 2018 the Annual (!) Average Return in the portfolio (my stocks-selection of 13 stocks) would have still been a nice +17.45%. The Maximum Drawdown in that period was only a nice minus of max. 3.63%. The Best year was 2017 with a plus of +37.02%, the worst of the last 3 years the year 2015 with a Plus-performance of +6.89%.

Going all the way back to the initial start of the Backtest (year 2004), the annual average performance has been > +17% p.a (!). The time-series only experienced one negative year with a Minus-performance of - 9.06% (in the year 2008).

Final conclusion: Currently (as per April 2018) the momentum-intensity check proposes an investment-ratio of ca. 60%. Interesting observation, that the mean investment-level of stocks in the portfolio would have been ca. 59%, if one computes a fixed level for the period January 2015 - March 2018.