Related Categories

Related Articles

Articles

Artificial Inteligence Trading-System

Focusing on powerful algorithms and modelling techniques allows one to extract the most information from ones data ("BIG DATA") and find correlations, using regressions and Backtesting. Here explanations on AI and 2 highly profitable FX-systems.

Algorithms

♦ Machine Learning

Machine learning, one of three subcategories of artificial intelligence, provides a basis for data mining. It seeks to answer the question: "How can we build algorithms that automatically improve with experience?" Formally, it can be defined as an algorithm that is able to learn from an experience, with respect to some task, as measured by a performance metric.

In trader's terms, this an algorithm that looks at an indicator value (the experience) to make a trade (the task), with its success measured by the profitability of that trade (the performance metric). The algorithm then tries to learn what indicator values lead to the most profitable trades.

♦ Data Mining

Data mining, a subfield of computer science, is the extraction of underlying, previously unknown, and valuable information from data.

Some main techniques for data mining:

Association Rule Learning

Association rule learning is the method of finding interesting relationships, or rules, in a data set. The advantage of these rules is they can often be written in simple forms such as "if the RSI is below 30 and volume up more then 2% then buy".

Classification

Classification is the prediction of discrete "classes" of outputs. For example, a classification algorithm would predict whether the market will move "Up" or "Down", as opposed to the magnitude of the move.

Regression

Regression, in contrast to classification, is the prediction of a continuous, numeric value.

It would output the direction and magnitude of a market move, for example +.017%.

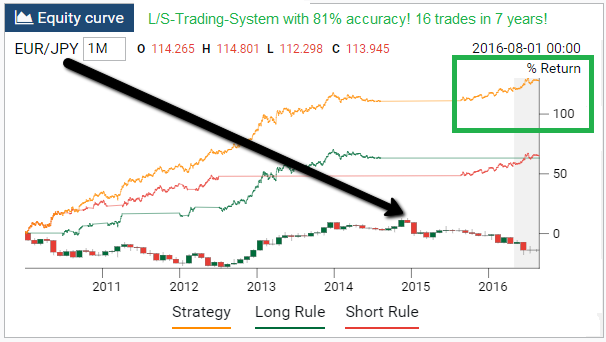

Versus the 1st Equity/Performance-Curve shown for the EUR/JPY-pair in this Trading-System above (EUR/USD), the FX-pair EURUSD was tested against spefic fundamental underlying data (Interest rates) and depending on various movements in the interest-rates a LONG-Trade OR a SHORT-Trade was executed (pure automated SIGNAL!). The system only made 10 trades from 2010 until Aug. 2016 with a trade accuracy of 90% (!). Tthe best-performing trade (SHORT-Trade that was) was opened on the 12th Aug. 2014 @ EUR/USD 1.3381 and was closed on the 6th March 2016 @ 1.1006.

♦ Association Rule Learning

Association rule learning is the method of finding interesting relationships, or rules, in a dataset. These rules are usually written as "if/then" statements such as: "if volume is up by .02%, then there is a 65% chance the asset price will rise in the next 4 hours."

Trading-System: traide.inovancetech.com (explanations taken from them)