Related Categories

Related Articles

Articles

Valuation US-Stock-Market

March2020

During much of the late 1950s and throughout the 1960s, the S&P 500 was highly priced relative to book value. The U.S. stock market achieved healthy rates of return as (relatively) low interest rates made equities relatively more...

...attractive. Interestingly enough, for some quarters now (since July 2019) the Risk-Free Rate (US-10year-treasuries) has fallen below 2%, indicating that an investment in these US-Bonds would lead to negative real returns. That perception implicitely assumes, that the inflation rate is currently hovering around +2%. (Status: as per 30th March 2020)

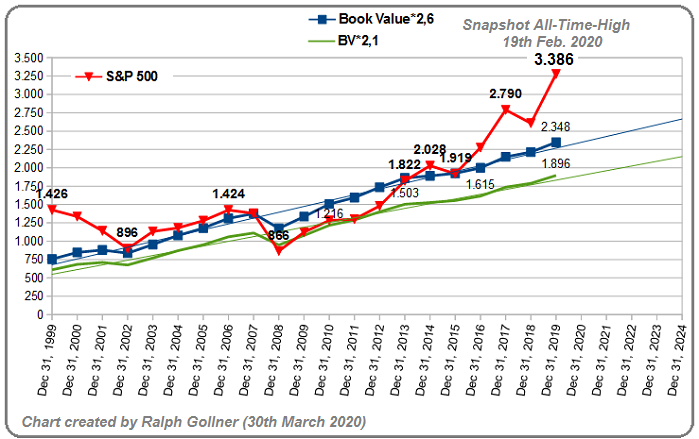

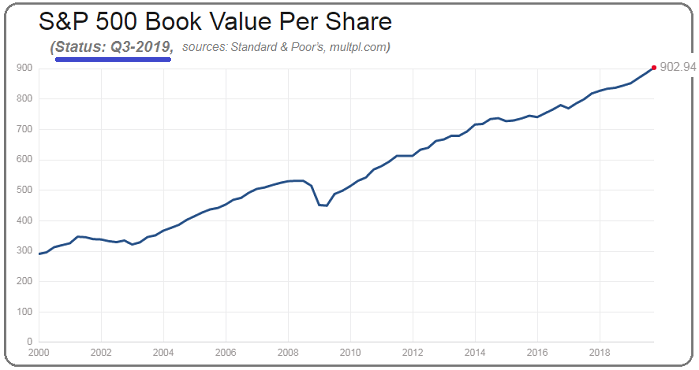

In the chart above I took a reasonable multiplier -based on the regression of 90years-long data- for the Book Value to arrive at a potential S&P 500-Index bottom/support-zone. In the chart below one can see, how the Book Value of the index evolved over the last 20 years (2000 until 2019):

Following the relationship between stock market returns and valuation ratios Price-Book (P/B-ratio) is one of the best predictors of long-term returns in 17 MSCI Indexes from 1979-2015 according to "Star Capital-research":

Further Explanation from "Star Capital":

The table above show the average returns over the subsequent 10-15 years in relation to the indicator under investigation. In addition to the returns, the correlations between the valuation ratios and subsequent returns in different countries are also illustrated. The group "MSCI Indexes" contains 17 MSCI country indexes since 1979, a selection of countries is presented.

All indicators have in common that low valuations were followed by higher returns than high valuations. For more details, see StarCapital Research paper "Predicting Stock Market Returns Using the Shiller-CAPE: An Improvement Towards Traditional Value Indicators?" (January 2016).

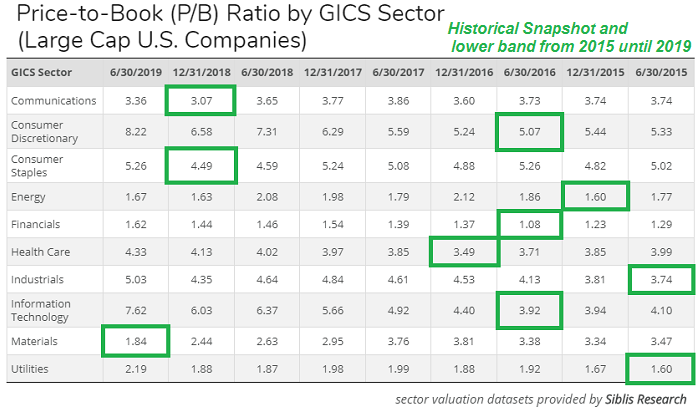

Let's also take a brief look at a breakdown regarding the P/B-ratios of various US-Industries

and their development during the last years:

Conclusion:

Armageddon has not arrived yet. We are currently in the middle of the storm and not really sure about the outcome, or length of this extraordinary period. The longer this "lockdown-state" takes, the more damage will be done to the global economy, delivery chains and companies.

One of the most important tasks during these times: Risk Management (again & again)

GOOD LUCK to all of us!

Ralph Gollner

links:

https://brownwealthmgt.com/its-true-that-equities

www.private-investment.at/posts/view/309

www.cmgwealth.com/ri/on-my-radar