Related Categories

Related Articles

Articles

Earnings Yield vs. Bond Yield

("Fair Valuation" / Fair P/E ?)

As you learn in finance 101, the value of an asset is based on its future cash flows. To get a present value, you must discount this cash flow, or earnings, using an interest rate. When interest rates are high, the...

...Price-Earnings multiples (PE) of stocks are low, and vice versa. Thus, the interest rate peaks in 1921 and 1981 correspond to low PE multiples.

We know there is a relationship between interest rates and stock market valuation. Some criticized the old Fed model (10-year bond yields compared to the earnings yield of the S&P 500 index) saying that there was a correlation between the two for only a short period in history but there hasn't been a correlation between them for most of history. This is true, but it is also true that there is a logical connection between them so we can't deny a relationship just because we can't get some charts to look convincing.

Anyway, just for fun, let's play around with the empirical figures. What may happen, if the stock market should be valued at if interest rates normalize. empirically.

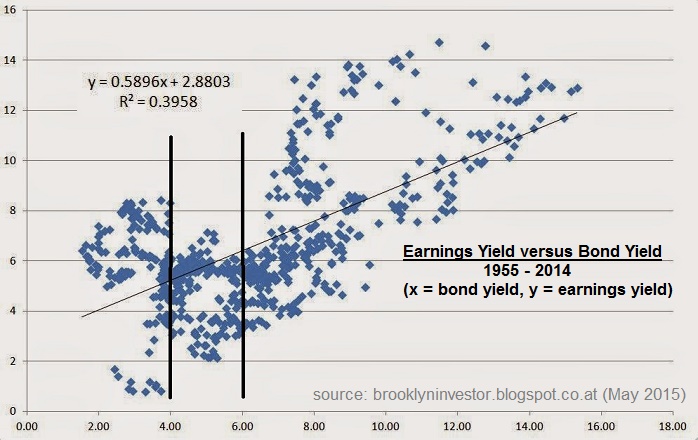

Recheck the above X-Y plot chart. Let's go back to go back to the chart from 1955 to include more data. Data before 1955 may not be too meaningful, plus 59 years is enough data for this.

Vertical lines between 4% and 6% were drawn. The question there is: What is the average earnings yield (and standard deviation) of the stock market when interest rates were in this range? Keep in mind that this interest range is far higher than where interest rates are now.

When interest rates were between 4% and 6% since 1955, the stock market traded at an average P/E of 20.4x. If you put standard deviation bands around the cluster, the range would be 16.6x - 26.6x for one standard deviation.

Just for fun, let's see these figures from 1980-2014. Some will argue that this is no good since the market has been overvalued for most of the past three decades. But again, let's just see for fun:

Interest rate range average P/E

4% - 6% 23.3x

4% - 7% 22.7x

If you do it by constant range (instead of expanding it) you get:

Interest rate range average P/E

4% - 6% 23.3x

6% - 8% 19.6x

Using data since 1980, even if rates went up to the range of 6-8%, the market could (!) be fairly valued at 19.6x P/E.

Higher stock-market valuations should be expected when the S&P 500 is trading at (even) lower interest rates. I know what you are thinking, "Yes, but how long will that last?" When you exclude periods where the ten-year Treasury offered yields above 6.5%, the average P/E ratio for the stock market as a whole is 19.5. By that gauge, the current valuation of 18x-19x earnings should (really) be near fair value.

Right now, the ten-year bond yields ca. 2.32% (Status: 11th April 2017).

The relevant question is not really whether rates will increase, but rather, how much. If interest rates for the ten-year U.S. bond stay below 6.5%, the current valuation is right in line with historical norms. Unless you think interest rates will exceed 6.5% within the next five years, I would not worry about significant, meaningful harm striking the S&P 500 as a whole due to the interest rate dilemma (day-to-day swings in response to interest rate projections are of course fair game).

Reminder on the Strong Dollar

...IF FX NOT HEDGED (recheck the HQ-Treasury Departments ;-)

should then -by Theory- reduce Profits

Something between 40% and 45% of the S&P 500's annual earnings might come from overseas, and the United States dollar has outperformed the global basket of currencies index by almost 25% in the past year. The strength of the dollar has weighed down to the international component of corporate profits, and that is why long-term investors buying now might be in a better position than they might initially think ?

links:

www.suredividend.com/4-things-you-must-know

http://brooklyninvestor.blogspot.co.at/2015

http://brooklyninvestor.blogspot.co.at/2014

https://seekingalpha.com/article

critical content versus FED-Model (Read with skepticism)

https://papers.ssrn.com/sol3/papers