Related Categories

Related Articles

Articles

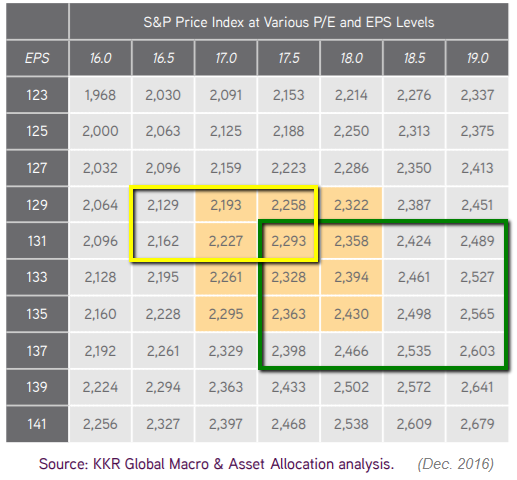

S&P 500 Valuation (HY2 / 2017)

The S&P 500 should be able to trade around a 17-18x P/E Multiple...In the context of the inflation outlook in the U.S. and the developed world, there appears to be little risk for earnings multiples in the short term.

Posting from 11th April 2017 / Valuation S&P 500 (P/E under Inflation): In the context of the inflation outlook in the U.S. and the developed world, there appears to be little risk for earnings multiples in the short term. Historically, zero to 2% inflation has remained the sweet spot for valuations. Please klick here for the original posting on my website:

www.private-investment.at/posts/view/691

As additional gimmick the following S&P 500-Chart, which shows the possible relevance of the magic 2,300 level as indicated in the PE-Overview shown above (a possible "last-level-support"):

link:

Global Macro Trends / Jan. 2017: www.kkr.com/global-perspectives/publications