Related Categories

Related Articles

Articles

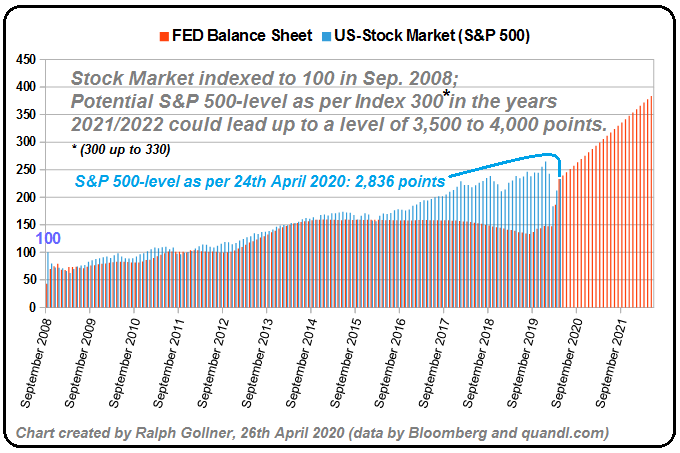

Fed Balance sheet potentially propping up the US-Stock Market (?)

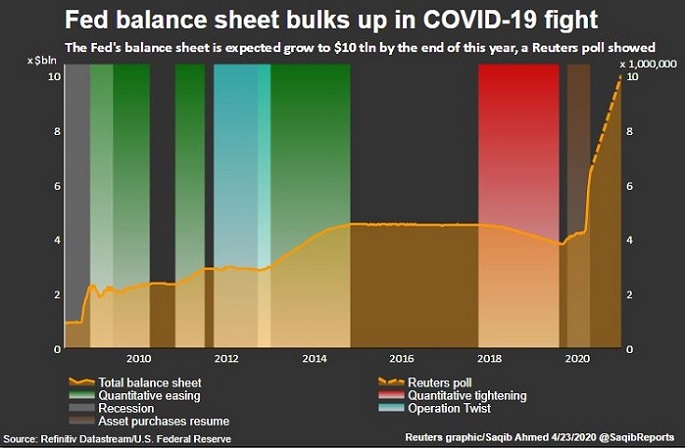

IF and only if the Federal Reserve will pull up its Balance sheet up to over 10 billion USD, my guess is that this could also have "some" material impact on the US-Stock Market (S&P 500-Index). The "FED" may hold interest...

...rates near zero for three or more years, and its balance sheet will soar above USD 10 trillion as policymakers seek to revive the U.S. economy from recession, economists said in a Bloomberg survey.

Just over half the 31 respondents to an April 20-23, 2020 poll predicted the target range for the federal funds rate, now at 0-0.25%, won't move up until at least the year 2023.

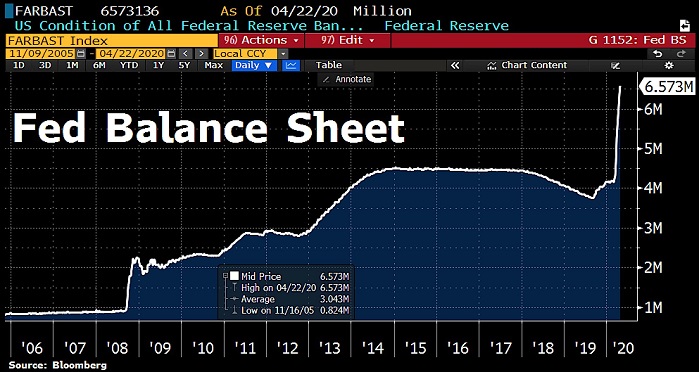

The balance sheet has already reached USD 6.57 trillion, as of 22nd April 2020, driven by USD 1.64 trillion in purchases of Treasury and mortgage-backed securities since 11th March 2020 to help calm credit markets that came to a near stand-still last month. The Fed is also soon to launch a number of credit facilities - with the ability to lend trillions more - aimed at directly and indirectly aiding companies, states and cities.

links:

www.cnbc.com/2019/11/07/the-feds-monetary-juice-has-tied-directly-to-the-rise-in-stocks.html