Related Categories

Related Articles

Articles

US-Stock-Markets are not that expensive

...correct?

Nobel laureate Robert Shiller, who created the CAPE ratio, co-authored a Barclays report with Laurence Black of The Index Standard and Farouk Jivraj of Barclays. They cited low interest rates as pushing up valuations. They further...

...described equities as appearing "highly attractive" relative to bonds.

The CAPE ratio is a long-term, inflation-adjusted price-earnings (P/E) ratio. For the U.S. markets, it measures the S&P 500 index against inflation-adjusted earnings for the past 10 years. Since 1880, it has ranged between 4.8 and 44.2 with an average value of 17.1. The ratio fell to a multi-year low of 24.82 in March as the stock market bottomed in response to the coronavirus pandemic.

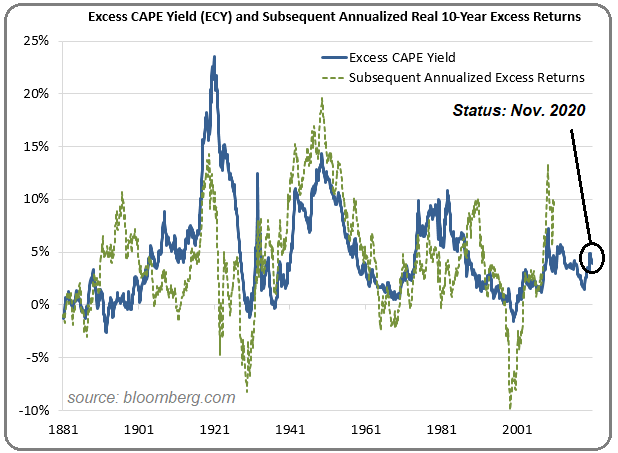

A newer measure shows the ratio as being less pricey. The excess CAPE yield adjusts for long-term interest rates. It is the inverse of the current CAPE ratio (1 ÷ CAPE) minus the real (inflation-adjusted) 10-year interest rate. Inversing the CAPE ratio creates a long-term, inflation-adjusted earnings yield. It is akin to the traditional earnings yield (earnings for the last four quarters divided by price, or E/P) that is used to compare stocks to bonds.

Based on this measure, stock valuations are well within historical norms. The November excess CAPE yield of 3.9% is between the historical average of 4.7% and the historical median of 3.5%. For those who are curious, the ratio has gone negative before. The last such time was between May 1999 and November 2000. A negative excess CAPE yield suggests that bonds have more upside than stocks.

Eventually, Shiller and his co-author write:

The trio published a Project Syndicate-article in November 2020: In it, they wrote, "Eventually, down the line, bond yields may just rise and equity valuations may also have to reset alongside yields. But at this point, despite the risks and the high CAPE ratios, stock market valuations may not be as absurd as some people think."

links:

www.project-syndicate.org/commentary

www.bloomberg.com/opinion/articles

Blog Aswath Damodaran (ERP-chart, Status: Oct. 2020)

https://1.bp.blogspot.com