Related Categories

Related Articles

- Entscheidungsfindung/Asset-Allocation

- Asset Allocation (annual performance/history)

- Decade Returns 1930 through 2009

- Portfolio-Example (what is possible?)

- Asset Allocation (minimum loss year 1/25)

- Ray Dalio about Asset Allocation

- Asset Allocation (annual performance/2003-2015)

- Dividend payers - Portfolio selection (Backtest)

- Minimum Varianz (1. Versuch), 1996 - 03/2016

- Intermarket (Snapshot/different Assets)

- Paulson (Berühmter Hedge-Fonds)

- Warren Buffet vs S&P 500-ETF vs Hedge Funds

- Momentum Strategy (strong sectors)

- Lifetime-Investment-Strategy (source: AAII)

- S&P 400 Total Return (great Index)

- Umfrage unter österr. Vermögenden (Asset Allocation)

- Top 100 BrandZ 2015 (Performance Recap)

- Great Portfolio 1 (CAGR: > 24% p.a.)

- Buy & Hold Skyrocket-Portfolio

- Buy & Hold-Strategie (Ralph Gollner)

- Ralph Gollner vs. BC-Zertifikat

- Ray Dalio versus ZUKAL und W. Buffet

- AbsoluteReturn-Ansatz vs. Ray Dalio

- Anlagestrategien (exemplatisch 02/2016 - 08/2016)

- BOFA Fund Manager Survey (Aug. 2016)

- George Sors & Carl Icahn

- Hedge Fund (Paul Tudor Jones)

- AFA statt FANG

- The S&P 500-Timing-Portfolio (1996 - 08/2016)

- Asset Allocation (Bsp. aus Juli 2016)

- DAX (7 Aktien), Experiment (Backtest)

- David Blood, Al Gore - Sustainable Capital.

- Correlation between stocks

- Has Warren Buffet Lost His Appetite?

- Warren Buffet versus Indices, ETFs

- Magic ("lower") Risk - Stock-Portfolio (2004 - Sep. 2016)

- Minimum Vola-Strategien (Zertifikate, ETFs, etc.)

- Watch out for the BIG ROTATION (Trump-effect)

- Timing Strategy (Risk-reduction Stock-Markets)

- Dow Jones Ind. Average-components (1999-2016)

- The power of a diversified "US-biased" Portfolio

- Inflationproof (?) ALLWETTER_Portfolios ('03-2016)

- Das "Marktportfolio" (Status: 2015)

- Benjamin Graham on "Asset Allocation"

- Who or what is Renaissance (Competition ;-)

- Initial investment and contributions (ca.7 years)

- US Stock Market vs. 10-year Treasury (1972 - 2016)

- Pensionsfonds Global und AT

- ETF-Savings/Investment Plan (2007-Nov. 2016)

- Sectors - Performance U.S.A. (1999 - Nov. 2016)

- Real-Word-Diversification (2003 - 2015)

- Anlegerverhalten (Umfrage 2016)

- Factors (Value, Size, Momentum) vs. Correlation

- DAX (8 Aktien), Experiment (Backtest)

- Most Admired Companies Survey (Fortune)

- 25Jahres-Perioden (US-Aktienmarkt)

- Long-Term Investing (Recheck Kelly-formula!)

- Der Value-Zyklus (NOW?!?)

- Zufriedenheit mit einer positiven Rendite...

- Branchen-ETF (some risk, some fun?)

- 30years (starting point: Check out the P/E)

- Backtest (March 2009 - 2016)

- Sortino-Ratio (Portfolio-Backtest)

- USA (Home-Bias), period: 1975-March 2017

- Österreicher und "Die Aktie"

- ÖBIB (Österreich)

- The "connected cars" market

- DAX-Sparplan - Szenario bei "Worse Case"

- Berkshire Hathaway versus Renaissance Techn.

- Vermögensaufbau (Rendite, Risiko)

- Sparplan-Simulation auf den DAX (2015 - Juni 2017)

- Combining Value & Momentum (!)

- rG versus Warren Buffet (*ggg*)

- Walter Schloss (record)

- Retirement & Dividends

- Investitionsquote "Aktien" (Mag. R. Gollner, skizziert)

- "The Permanent Portfolio"

- Deutsche Staatsanleihen (Reale Verzinsung neg.)

- Top BrandZ 2017 - Selection from Top 100

- Cost of Capital (WACC)

- Ansparplan - langer Anlagehorizont

- Immobilienmarkt Österreich (Wien)

- XLB (US-Materials Sector)

- Bonds in a rising interest environment (History)

- Definition einer dynamischen Investitionsquote

- Well, he admits it...

- Billy Axman (Bill Ackman)

- Bonds vs. Stocks (Warren Buffet)

- Dynamische Investitionsquote (23. März 2018)

- Swimming naked...

- The period 1982 - 1999 (Kindergarden)

- 10year US-Treasuries and Dow Dividend Stocks

- Two rivals of the U.S. Stock Market

- Warren Buffet vs. Carl Icahn (2010 - Apr. 2018)

- Portfolio "German-Austrian"

- GAFAM (sehr konzentriert, Risky Risky)

- German-Austrian (Mag. R. Gollner)

- Möglicher Anlagezeitraum (30 Jahre?), Lernkurve

- Roboter und Marketing (...)

- Mission Impossible 2019 - 2028

- "German-Austrian" (Mag. Ralph Gollner) vs. DAX

- Oakmark vs. Warren Buffet vs. Danaher

- Julian Robertson ("Tiger")

- QQQ & ^Gold "Timing Portfolio"

- The Race For AI (Status: Q1-2018)

- "German-Austrian" vs. "LieberMann-Strategie"

- David "Unicorn" and some downturn...

- Asset classes / History

- Returns and Standard Deviation (1956 - 2015)

- Wiener Zinshausmarkt versus Aktien (?)

- Spin-off (Investment opportunity ?)

- Time is over: Warren Buffet (?), July 2018

- Venture Capital (magic returns?)

- US Top 10 companies

- Hanni-Börsday :-)

- David Einhorn is losing (Status: Sep. 2018)

- All we need is just a little patience...

- Piotroski F-Score (Backtest)

- Privater Zins-Tilgungsträger (2018 bis 2034)

- ETF-Cocktail (Backtest since my birthday ;-)

- Backtest of 8 US-Stocks (2002 - Sep. 2018)

- Gr8 Outperformance versus S&P 500 ('95 - 2018)

- Nachhaltige Geldanlage (2002 - Sep. 2018)

- Deutsche Anleihen(Rendite nach Inflation), 2018

- Ich baue mir (m)eine Privatpension (Jahr 2018)

- Meine Aktien-Investitionsquote (Dez. 2018)

- US-Equity Risk Premium (Dec. 2018)

- Ralph vs. Warren Buffer & Oakmark funds

- Investmentfonds-Methusalem (1934ff)

- "BASM" (Fred Kobrick)

- Stock Market Returns (U.S. stocks)

- U.S. Stock Market Returns by Decade

- Top Brandz (2018)

- Global GDP-Growth (source: OECD-Video

- Trump and the Trend-Followers (freaky stuff)

- Long-Term-Investing (20 years+)

- Bond yield versus Dividend yield

- Aktienquote in einem Portfolio (26.03.2020)

- M/eine Aktienquote (7. April 2020)

- Aktien-Investionsquote & Covid-19

- Reflation Trade (5th June 2020)

- Aktienquote per Mai 2020

- BLACK SWAN-BACKTEST (2010 bis Jänner 2020)

- LIRP-environment & Cash-yields (year 2020)

- Asset-Allocation (Crypto-Cocktail)

Articles

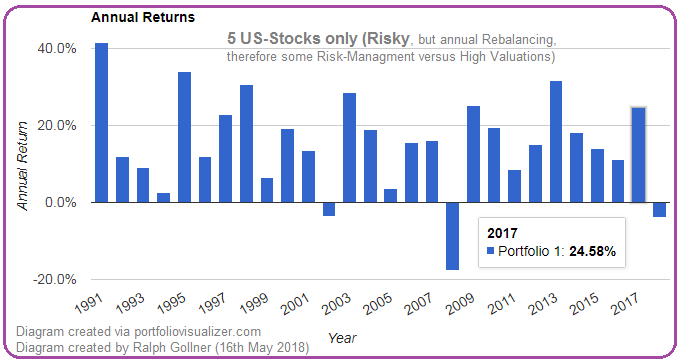

5 US-Stocks Portfolio

(High Risk, Annual Rebalancing)

Warren Buffet says, sometimes concentration can help you in achieving great Return-figures. But only, if you really know what you are doing. Well, here I made a backtest of 5 US-Stocks, which are from the Food & Drinks...

...Sectors, but also from the IT and Industrial sector. It can also be said, that two stocks are currently components of the Dow Jones Industrial Average-Index.

A CAGR of 15% since the year 1991 looks like a nice return. From Jan. 1991 until April 2018 this compound annual return figure led to a final outcome of + 4,580%. There were three negative years since 1991, the worst being (of course) the financial-crisis year 2008, where the portfolio produced a loss of minus 17.68%.

Conclusion: If you cannot handle 3 negative years in a timespan of 25 years...well...