Related Categories

Related Articles

Articles

"The Permanent Portfolio"

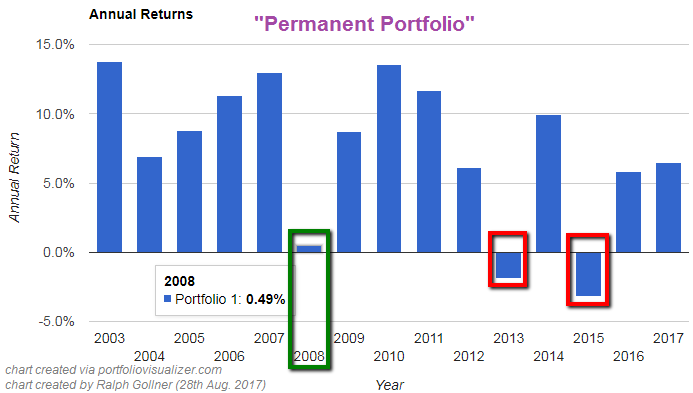

The Permanent Portfolio is an approach to creating a diversified portfolio using a static asset allocation. I computed a Backtest on a reasonable "Minimum-Investment-Horizon" resulting in a 3 years-investing period as a senseful minimum in order to achieve a high...

...probability of achieving a positive outcome. The idea of a "Permanent Portfolio" may tempt some investors. The premise is simple: invest in a carefully chosen collection of non-correlated assets and occasionally rebalance. It sounds easy, but how did this "idea" perform?

The idea is about having a reduced equity portfolio that uses a "permanent", fixed allocation designed to weather a variety of market conditions. The object is therefore to "preserve" and increase the purchasing power value over the long term. Over the last decade, the performance points more to "preserve" rather than "increase." But still: you had an exposure to equities, which otherwise would look to risky for some risk-averse investors.

Harry Browne had this to say about the permanent portfolio: "The portfolio's safety is assured by the contrasting qualities of the four investments - which ensure that any event that damages one investment should be good for one or more of the others. And no investment, even at its worst, can devastate the portfolio - no matter what surprises lurk around the corner - because no investment has more than 25% of your capital."

A Strategic Portfolio Recipe using ETFs: A static ETF model portfolio with ingredients that does not change month-to-month but is rebalanced monthly (or quarterly?) to match the target allocation.

Harry Browne-Inspired Portfolio has an annual return of ca. 6% over the past 10 years with maximum drawdown of ca. 12% - 13%. This portfolio allocates equally to stocks using the Vanguard Total Stock Market ETF, the long-term U.S. Treasury index using the iShares 20+ Year Treasury Bond ETF (TLT), cash, and gold.

This portfolio "Harry Browne's 4-part portfolio" therefore allocates one-fourth each to VTI, TLT, GOLD and Cash.

A "newer" approach (since Cash is interest-less nowadays): This stocks portfolio-strategy starts with Harry Browne's 4-part portfolio, but then slowly removes the cash component to increase the portfolio's total return. The recipe eventually allocates one-third each to VTI, TLT, and GLD. Once cash is not a part of the portfolio the risk increases somewhat but the annual return improves.

A final look in the recent (riskier) years: In the period from 2013 onwards, the permanent portfolio also showed its pitfalls, since Bonds will not rise forever - since "normally" there should be a floor found at some level for an appropriate bond - yield (currently US-Treasuriers yield about 2.2% per year). As Gold and Equities are also two further ingredients these components experienced some hickups in the last years (year 2013 and 2015):

links: