Related Categories

Related Articles

Articles

Retirement & Dividends

The end goal of many dividend growth investors is to create a dividend stock portfolio (composed of ETFs or even individual stocks) that generates enough income to cover their retirement expenses. With that in mind, this article investigates your chances...

...of retiring off of dividend income using different savings rates and time horizons.

Some Benchmark Parameters & Assumption

If you are investing in broad-based index ETFs (which is a great choice for the vast majority of investors), then the two most important factors in your long-term investment success are:

♦ Your savings rate

♦ Your time horizon

Because of the importance of these two metrics, they are the two main variables that will tweaked in this analysis. More specifically, we will consider savings rates from 10%-50% (using incrementals of 10%) and time horizons ranging from 45 years to 15 years (using 5 year increments). Using the traditional retirement age of 65, this implies a starting investment age of 20 to 50 ! (still sounds logic, i assume)

This analysis will estimate future investment returns by fitting a normal distribution through the historical returns of the S&P 500 Index ETF, which trades under the ticker SPY on the New York Stock Exchange. SPY is a well known investment option for long-term investors seeking broad-based equity exposure and already knowing about the theory behind ETFs and ETF-Investing!

In fact, Warren Buffett often speaks about a portfolio containing 90% SPY and 10% in short-term government bonds for the average U.S. investor with limited financial experience. Since 1993, SPY has had an average daily total return of 0.042% and an average daily total return standard deviation of 1.163%. Nick Magiull (the guy who is running the scenarios) is using daily returns (rather than monthly returns or annual returns) because this increases the sample size under consideration. In reality, stock market returns do not perfectly fit the normal distribution; but it is a close enough proxy for the purpose of this analysis. R was used to run a 1000-trial Monte Carlo simulation for each time horizon-savings rate pair.

Another assumption - for simplicity's sake- that the person who is doing the investing has an annual income of USD 70,000 per year. This analysis would yield the same results for any other assumed income; but some level of income must be selected to compute the dollar value of invested capital given a particular savings rate.

The last assumption to be made is about dividend yield. The S&P 500 Index ETF currently has a dividend yield of about 1.9%. This is certain to change over time; however, we have about as much information on what the S&P 500 yield will be in 15-45 years as we do about the weather in 15-45 years. In other words, we are all clueless.

This means that using its current 1.9% dividend yield as a proxy for future dividend income is conservative. Thus, 1.9% will be the rate used to determine dividend income once final portfolio values are computed using the Monte Carlo simulator.

The Simulation Results:

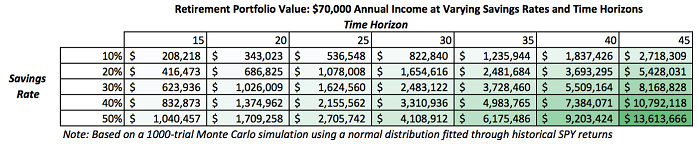

Here are the retirement portfolio values and the subsequent/resulting annual dividend-Income Flows after investing in the S&P 500 over various time horizons and savings rates using a USD 70,000 income for simplicity's sake:

While the first table above was interesting, we do not care so much about portfolio size. What we are really concerned about is our portfolio's ability to generate retirement income (see most recent Portfolio-income table). The following table then shows the retirement income generated from each of the portfolio sizes in the previous table, using the S&P 500's current dividend yield of 1.9%. Cells highlighted in green are sufficient to replicate the investor's annual employment income using dividends alone (where 112% explains, that after 30 years one could live off the annual dividends generated by the Dividend-portfolio; assumend one really saved ca. half on ones 70k-USD income each year in the 30years-span before - a truly unreal assumption !).

Importantly, one can also add other ETFs to ones established strategy. Versus SPY (ETF-ticker) there is also the VYM, which had almost exactly the same volatility as SPY since the inception of each ETF. Investors who need even more yield can look for other investment options like the VYM mentioned, ETFs that offer the prospect of higher dividend income.

Final Thoughts on the calculations and ASSUMPTIONS above

The article above showed the impressive power of dividend growth stocks for long-term wealth creation. With a sufficient savings rate and time horizon, investors stand a good chance of covering their entire living expenses on dividend payments alone. For the scenarios where dividends were not sufficient, the outlook is not necessarily bleak. It is alright to draw down some principal during retirement if you do not intend to pass on your full wealth to your heirs. Many people enjoy long and prosperous retirements by periodically selling some of their stock holdings. With that said, the best case scenario is to retire on dividends alone. This article showed that this is a distinct possibility using a long-term dividend growth investing strategy. But it may also require more global exposure (?) than in the past and maybe even more risk-tolerance...

REMINDER: PAST RESULTS are really not real INDICATION FOR FUTURE RESULTS !

Solving the Problem of Retirement...

Another view on this topic

Retirment is often a problem for those who have not saved enough to live comfortably. For many people in their 50s and 60s, that problem suddenly looms large as they are forced to confront a variety of realities.

The Problem

The problem of retirement is essentially that life can place potentially unlimited demands on your finite life savings. As a result, it can be very hard to know when you have enough savings in order to "safely" retire.

Let's start this article with a freaky example:

In this example, some elder People save around USD 1mn (in an asset portfolio: Stocks, Bonds, Cash, excl. Real Estate) before their retirement period begins. A decade or two ago, many advisers and financial experts believed and taught that a retiree (!) could safely withdraw 5% of their investment portfolio every year without much risk of running out of money. In recent years, one would have met very few people who wouldn't be satisfied with that formula. If you have USD 1 million when you retire, you could take out USD 50,000 a year for living expenses. (For the sake of convenience, I assume for the rest of this discussion that we're talking about a retiree with USD 1 million, even though many people have more and many others have less.)

Furthermore, the thinking went, investment returns were likely to at least keep up with inflation. That meant you could withdraw USD 50,000 in the first year and adjust that number upward every year for actual inflation. As it turns out, the success of that scenario depends largely on the luck of inflation and of market returns during the first few years of your retirement - neither of which can be foreseen. If this luck turns against you, you could be in real trouble.

To see how real this trouble is, take a look at following Table 1, which tracks what would have happened to somebody who retired in 1970, invested solely in the S&P 500 index and followed this formula. The startling news is that, after 10 years of retirement, the numbers show that you were locked into an unpleasant race to see which would run out first: your money or your life...

Some explanation: At the end of 1979, after just a decade of supposedly carefree retirement, your USD 1 million portfolio would have been worth only USD 803,741. At the start of 1980, you would have needed to withdraw USD 101,819, or 12.7% of your portfolio, just to meet your cost of living (USD 50,000 in 1970 dollars).

You can see from the dashes toward the bottom of this table that this course of action would have reduced your portfolio to less than USD 4,000 by the end of 1992. The other columns in the table indicate you could have prolonged the agony by another couple of years if you had kept 40% to 60% of your portfolio in fixed-income funds. The ultimate outcome would have still been the same: By the mid-1990s, you would have been broke.

These days, the standard withdrawal advice has shifted from 5% to 4%. (Some advisers are recommending withdrawals as low as 3%).

To see how 4% withdrawals would have worked, take a look at Table 2, which presumes that you could afford to live on a USD 40,000 withdrawal your first year in retirement. At first glance, this table looks much better:

SETBACK in "our backtest"

The analysis used to construct the table above covers 47 years, considerably longer than the retirement span most people can expect. However, there's a good chance that if you and your spouse retire at 65, at least one of you will still be around 30 years later at age 95. (Portfolios were halted if the balances fell to zero prior to the end of the 47-year period.)

Using that assumption, let's look at the year 2000, after 30 years of retirement. For inflation-adjusted living expenses that year, you would need to withdraw USD 179,221 from a portfolio that ended 1999 with a value of USD 6.5 million. That's a withdrawal rate of about 2.7%.

>> A (nice) piece of cake, right? <<

Well, not quite! In order to achieve that year-end portfolio value, you had to keep 100% of the portfolio allocated to stocks. Looking back now, we can see that was fine. BUT For retirees in their 80s and 90s, 100% equities can seem pretty scary. You could have significantly reduced that risk by keeping half your portfolio in equities and half in fixed-income funds...

I also think these returns may overstate the case of what we can expect in the future, since:

♦The 1990s included an almost unprecedented boom in U.S. stock prices.

♦ Plus, bond prices in the 1980s and 1990s benefited from a very long decline in interest rates.

♦ There's no way that could recur any time soon.

>> So should not really guess that the 4% rule, now widely quoted, is enough to solve "the retirement problem."

Really trying to solve the Problem

What's the answer? I propose three ways you can mitigate the problem. If you do as I have done with my own portfolio and put all three of them to work, you can effectively solve the problem. They are:

1) Diversify widely and sensibly beyond the mainstream U.S. stock market (represented by the S&P 500 index).

2) Adopt a flexible distribution system based on your portfolio value rather than a fixed inflation-adjusted budget set at the start of your retirement.

3) Before you retire, save considerably more money than you think you'll need.

...the 2nd second Idea for mitigating the retirement problem: taking flexible distributions instead of fixed ones, here you go:

Flexible Distributions

Our recent scenario was based on a USD 1 million initial investment made in 1970 with a need for a USD 50,000 withdrawal in the first year. The withdrawal amount is then adjusted each year for inflation. When that portfolio was invested in the S&P 500, the long-term scenario was derailed by the unceasing increases in the required withdrawal.

In six of the first 12 years of this retirement scenario, inflation was above 8%. That could not have been predicted, but it's always possible. Every year, inflation relentlessly drove up each required withdrawal, regardless of how the investments in the portfolio grew. Before too long, as we saw, the portfolio simply could not keep up.

There's a better way to take money out during retirement, at least for those who can afford it. That is to adjust withdrawals depending on how your investments are doing. This is essentially what any smart investor would want to do: Take out a bit more when things are going well, and tighten his or her belt a bit when the investment portfolio is struggling.

Such a flexible distribution schedule can't give you certainty in advance of how much you'll have. In this period starting in 1970, it would have required some serious belt-tightening. In 1980, instead of taking out USD 101,819 from a portfolio invested in the S&P 500, our hypothetical retiree would have had to get by on only USD 52,917...

Conclusion: As stock-owners we should always stay flexible and have an open mind - no surprise, in fact ;-)

links: