Related Categories

Related Articles

Articles

Bonds versus Stocks

(Bond yield versus Dividend yield)

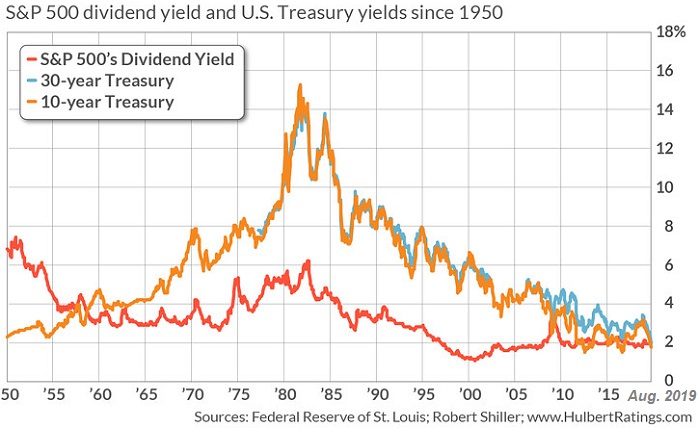

The yield on the 30-year Treasury bond which this week just fell below the S&P 500's dividend yield SPX, was reversing a relationship that - with only a couple of minor exceptions in recent years - has held since the year 1958.

Individual stocks now yield more than 5-, 10-, and 30-year US Treasury bonds, according to Bespoke's (Investment Group) research. As of this week (Last week of August 2019), two-thirds of the stocks in the S&P 500 yield more than the 5-year. More than 60% yield more than the 10-year, and roughly half are yielding more than the 30-year note.

"The takeaway is, if you can get an annual yield from a company that's going to pay you more than the 30-year Treasury and the company has a history of raising its dividend, for the long term, it's a better alternative than a Treasury," Bespoke Investment Group co-founder Paul Hickey said.

It's worth noting that most bond investors nowadays have no memories of the devastating bond bear-market that lasted from the late 1950s to the early 1980s. It will take a lot to overcome the serene view investors now have of the extraordinary bond bull-market of recent years.

"RECENCY BIAS"

In the equity arena, in contrast, investors' memories of the 2008 Great Recession remain fresh, and memories of the 2000 internet bubble also are more a part of investor consciousness than the devastating bond bear-market of prior decades.

This also suggests that the stock market's dividend yield may remain high relative to the Treasury yield...