Related Categories

Related Articles

Articles

(Real)

Long-Term-Investing

(20 years+)

Long Term is longer than you might think! Investment time horizon is a critical concept in building wealth. Most investors have very long investment time horizons, typically decades or more. Investment managers also...

...require long time horizons to deliver on their investment thesis. Finally, stock market volatility diminishes substantially over time, with a 75% decrease in variability for 10 years versus one year. As a result, developing patience and a long-term perspective are key to building wealth.

!PATIENCE!

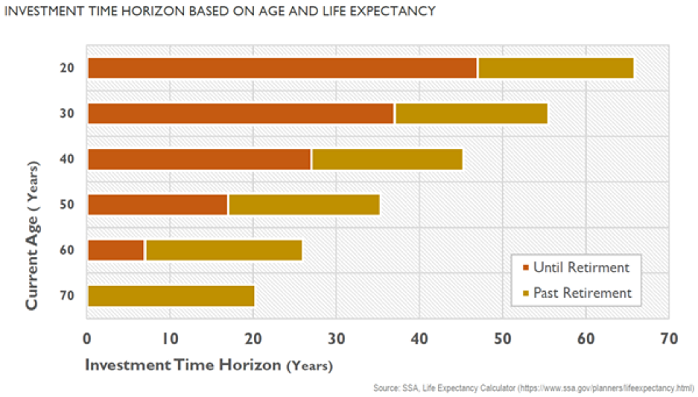

We are living longer and need to invest appropriately. Even at age 70, the investment time horizon could be another/more than 20 years!

The table above shows the number of years until retirement and the number of years past retirement for different ages, based on life expectancy and retirement at age 67. Successfully funding a long life into retirement requires consistent action, which includes making regular contributions while working and staying invested. Even in retirement, it could be important to stay (partially) invested in growth-oriented investments. The focus on short-term investment performance and the associated micro-management of portfolios is most often counter-productive to building long-term wealth.

Reminder:

Investing is a long-term game that requires patience and stamina. Unfortunately, we are hardwired to react to our emotions in the present at the expense of our future selves. With planning, separating out short-term cash needs from long-term investments can help to avoid emotional short-term bias. Like becoming a marathon runner, becoming a long-term investor takes time, effort and discipline. The challenge is not to find better investments, but to become a better investor.

link:

www.advisorperspectives.com/articles/2019/07/15/long-term