Related Categories

Related Articles

Articles

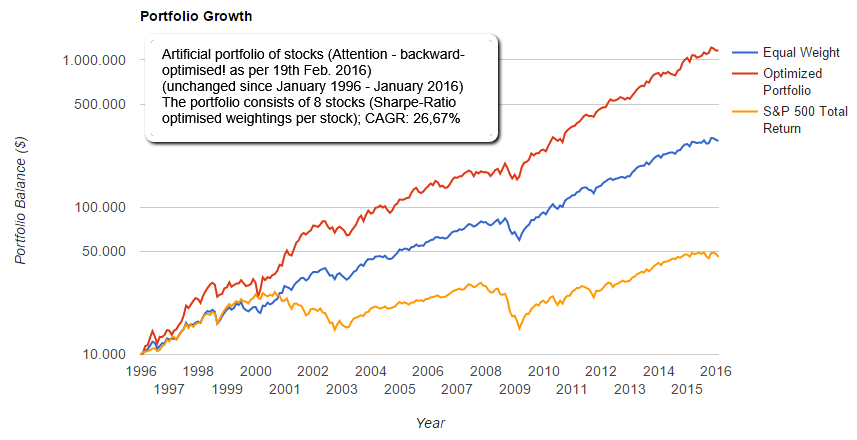

Portfolio-Example (what is possible?)

Period: 1996-2016

Before building a portfolio, one needs to know about ones investment-horizon. I would suggest 20 or even 30 years, anything below 3 (or 5) years may be very risky...Patience should be highly rewarded, as can be seen in this example:

I am not handing out the names of each component of this (example-)portfolio, but it should be noted, that the weighting of each stock over the lifetime was fixed and the same for the entire portfolio in 2016, simililar as in the year 1999, 2004, 2007 or 2012, etc. The portfolio will be tested again for its performance by the end of the year 2016.

Five companies have a Market Cap between 15 bn USD and 30 bn USD. One sporting-company in the portfolio has a Market Cap between 80bn US and 100bn USD (as per 18th Feb. 2016). As most readers may know, it depends on the sector, in which the company operates and also its financing structure, furthermore, if the organisation has built a USP and has a consistent expansion plan with great execution! Only then an investment may prove to be a good one and a sustainable cash-flow-producer.

In this respect it can be mentioned, that one of the companies is a car-parts-dealer with a revolving business-model (ORLY):

In the light of the down-performance of Warren Buffet in the year 2015, the 8-stocks-portfolio delivered a nice outperformance (PLUS 12%). Still, it should be mentioned, that the selection of these 8 stocks does not include some economy-sectors like energy or commodities (furthermore the stock-selection was reset BACKWARDS for calculation purposes 1996 up to Jan. 2016).

| Initial Balance | Final Balance | Return per year | Std. Dev. ("risk") | Best year | Worst year | Max. Drawdown | Sharpe Ratio | US Market Correlation | |

| Optimized Portfolio | 10k USD | 1.15 mn USD | 26.67% | 19.38%% | +63.4% | -4.63% | -24.06% | 1.21 | 0.60 |

| S&P 500 | 10k USD | 45.8 k USD | 7.88% | 15.31% | +33.36% | -37% | -50.95% | 0.42 | n.a. |

Again, the portfolio is holding up in the (so-far-)downmarket in 2016, while the S&P 500 is diving into negative territory:

As mentioned above, one should always think about ones investment-horizon BEFORE buying the first round of stocks or (hopefully NOT HIGH-fee-) investment-funds. Therefore I will show, how a rolling-period of 3, better (at least) 5 years can lead to positive results. First, please take a look at the historical performance-record of the S&P 500 (US-Stock Market Index) from (1995)1998 up to 2015:

As can be seen above, some of the years 2000 up to 2009 were also the cause for the so-called "lost decade", since the irrational exuberance in the 80s and 90s of the last century destroyed upfront the "possibility of sustainable rising company valuations"...In comparison the great outperformance of the risky 8-stocks-portfolio (unchanged weightings of each component!) in the years 1995 up to 2015:

As can be seen above, some of the years 2000 up to 2009 were also the cause for the so-called "lost decade", since the irrational exuberance in the 80s and 90s of the last century destroyed upfront the "possibility of sustainable rising company valuations"...In comparison the great outperformance of the risky 8-stocks-portfolio (unchanged weightings of each component!) in the years 1995 up to 2015:

Following the negative performance which has been produced by some Hedge-Fund-Managers or "normal" Long-Only-Stock-Funds (now) in 2015 one should really re-think, if one is investing in the right products with the right Managers. Therefore one should always go through different information-sources, compare track-records of long-lasting funds and have a broad overview, also knowing which returns the stock-market can really provide.

Following the negative performance which has been produced by some Hedge-Fund-Managers or "normal" Long-Only-Stock-Funds (now) in 2015 one should really re-think, if one is investing in the right products with the right Managers. Therefore one should always go through different information-sources, compare track-records of long-lasting funds and have a broad overview, also knowing which returns the stock-market can really provide.

Most important to mention, that the average investor may not have nerves of steel, therefore the drawdown, or only the downmoves in a year should be recaped: in the year 2002 the "optimized portfolio of 8 stocks" finally made minus 4.6 % in that year (compared to minus 22% in the S&P 500). There is no gain without some (minor) pain ;-)

Please be aware that you should have deep knowledge and understanding of the markets (Mr. Market) before buying any stock! Paper Trading (NO real money) and gaining experience is the best way to start!