Related Categories

Related Articles

Articles

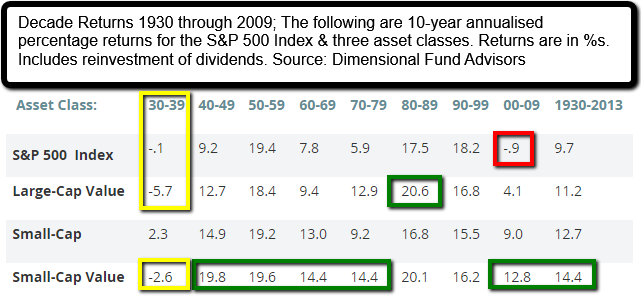

Decade Returns 1930 through 2009

Arguably the most important decision is choosing what kinds of things to invest in. Asset class selection is the name for this. As you can see, from 1930 through 2013, some of the different asset classes were substantially more rewarding than others:

source: http://www.marketwatch.com

source: http://www.marketwatch.com

In the stock market, you can invest in popular growth stocks or unloved value stocks. You can invest in big companies (large-cap) or small companies (small-cap). You can invest in U.S. stocks or in international stocks; you can also invest in emerging markets stocks and real-estate investment trusts.

According to the experts, more than 90% of your ultimate investment return depends on your choices of asset classes. (This assumes that you invest money and leave it invested. If you move in and out of your investments, then your results are totally unpredictable.)

The table above shows eight decades of returns for the four most important U.S. equity asset classes: Large-cap blend stocks (represented by the Standard & Poor’s 500 Index SPX), large-cap value stocks, small-cap blend stocks and small-cap value stocks. (The "blend" asset classes are approximately 50/50 growth and value; the "value" asset classes are made up almost exclusively of value stocks.)

Many people think the S&P 500 index represents "the market," but it doesn't. In fact, over the long haul each of the other three asset classes outperforms this index by a long shot, as you see from the right-hand column in the table.

One reason why the data above shows 10 years is also due to a famous maxim from Warren Buffett: "Don't buy something unless you would be willing to hold on to it if the market were shut down for 10 years." (my opinion/my 2 bits: well, for the average investor, this advice may really be the most probable solution of how to handle the -sometimes- unpredictable antics of "Mister Market").