Related Categories

Related Articles

Articles

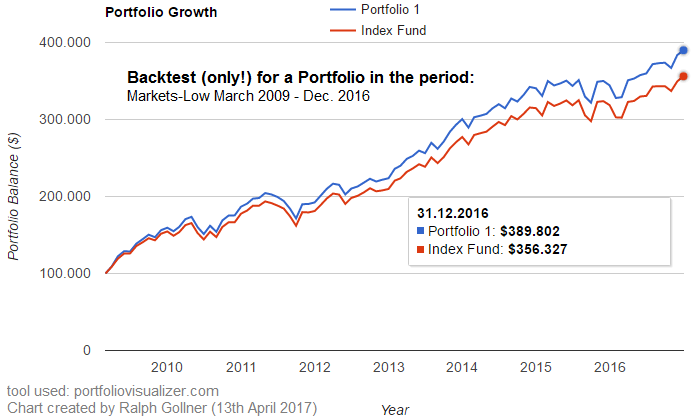

Backtest (March 2009 - 2016)

In the year 2009 the market was definitvely undervalued, if one believed in the continuation of the financial system...(please recheck valuation metrics, like Price-Book or Price/Sales, etc.). I made a backtest (one of many) and eventually may...

...have found a possible Asset-Allocation for resilience in these markets. (I named my backtest "Portfolio 1"; a possible Benchmark for a pro-risk-approach-Benchmark is given here with an "Index Fund").

Some rules on the way (in German we say: "Der Weg ist das Ziel"):

Preparing a Strategy. Knowing about history, learning from your mistakes made in the past. Mistakes made by others in the past. Therefore the need to diversify and to establish a resilient Risk-Management style.

Employ Stop-Loss ONLY, if really needed. Cut your losses, but also take profits, once a Bubble-Valation seems to develop in any given stock or even the whole market.

Starting point of the Backtest shown in the graphs/diagram (Start: March 2009) was an Investment amount of USD 100,000. Considering also Dividend Stocks (Dividend-Growth stocks) gives the investors the possibility of receiving regular dividend-payouts from "their" companies.

Status in 2016/2017: In the meantime, since 2009/2010 several companies have raised their dividend payments in the recent years (since many companies were also able to raise their yearly sales and earnings-numbers). Look out for receiving a regular (Dividend-)Income of Minimum USD 7k, since there might be some companies and their CFOs which do not even consider reducing the dividend payments to their stock-owners! ...

...Especially when the payout-ratio for the dividend payments is below 60%, 70% of the yearly profits !