Related Categories

Related Articles

- Entscheidungsfindung/Asset-Allocation

- Asset Allocation (annual performance/history)

- Decade Returns 1930 through 2009

- Portfolio-Example (what is possible?)

- Asset Allocation (minimum loss year 1/25)

- Ray Dalio about Asset Allocation

- Asset Allocation (annual performance/2003-2015)

- Dividend payers - Portfolio selection (Backtest)

- Minimum Varianz (1. Versuch), 1996 - 03/2016

- Intermarket (Snapshot/different Assets)

- Paulson (Berühmter Hedge-Fonds)

- Warren Buffet vs S&P 500-ETF vs Hedge Funds

- Momentum Strategy (strong sectors)

- Lifetime-Investment-Strategy (source: AAII)

- S&P 400 Total Return (great Index)

- Umfrage unter österr. Vermögenden (Asset Allocation)

- Top 100 BrandZ 2015 (Performance Recap)

- Great Portfolio 1 (CAGR: > 24% p.a.)

- Buy & Hold Skyrocket-Portfolio

- Buy & Hold-Strategie (Ralph Gollner)

- Ralph Gollner vs. BC-Zertifikat

- Ray Dalio versus ZUKAL und W. Buffet

- AbsoluteReturn-Ansatz vs. Ray Dalio

- Anlagestrategien (exemplatisch 02/2016 - 08/2016)

- George Sors & Carl Icahn

- Hedge Fund (Paul Tudor Jones)

- AFA statt FANG

- The S&P 500-Timing-Portfolio (1996 - 08/2016)

- Asset Allocation (Bsp. aus Juli 2016)

- DAX (7 Aktien), Experiment (Backtest)

- David Blood, Al Gore - Sustainable Capital.

- Correlation between stocks

- Has Warren Buffet Lost His Appetite?

- Warren Buffet versus Indices, ETFs

- Magic ("lower") Risk - Stock-Portfolio (2004 - Sep. 2016)

- Minimum Vola-Strategien (Zertifikate, ETFs, etc.)

- Watch out for the BIG ROTATION (Trump-effect)

- Timing Strategy (Risk-reduction Stock-Markets)

- Dow Jones Ind. Average-components (1999-2016)

- The power of a diversified "US-biased" Portfolio

- Inflationproof (?) ALLWETTER_Portfolios ('03-2016)

- Das "Marktportfolio" (Status: 2015)

- Benjamin Graham on "Asset Allocation"

- Who or what is Renaissance (Competition ;-)

- Initial investment and contributions (ca.7 years)

- US Stock Market vs. 10-year Treasury (1972 - 2016)

- Pensionsfonds Global und AT

- ETF-Savings/Investment Plan (2007-Nov. 2016)

- Sectors - Performance U.S.A. (1999 - Nov. 2016)

- Real-Word-Diversification (2003 - 2015)

- Anlegerverhalten (Umfrage 2016)

- Factors (Value, Size, Momentum) vs. Correlation

- DAX (8 Aktien), Experiment (Backtest)

- Most Admired Companies Survey (Fortune)

- 25Jahres-Perioden (US-Aktienmarkt)

- Long-Term Investing (Recheck Kelly-formula!)

- Der Value-Zyklus (NOW?!?)

- Zufriedenheit mit einer positiven Rendite...

- Branchen-ETF (some risk, some fun?)

- 30years (starting point: Check out the P/E)

- Backtest (March 2009 - 2016)

- Sortino-Ratio (Portfolio-Backtest)

- USA (Home-Bias), period: 1975-March 2017

- Österreicher und "Die Aktie"

- ÖBIB (Österreich)

- The "connected cars" market

- DAX-Sparplan - Szenario bei "Worse Case"

- Berkshire Hathaway versus Renaissance Techn.

- Vermögensaufbau (Rendite, Risiko)

- Sparplan-Simulation auf den DAX (2015 - Juni 2017)

- Combining Value & Momentum (!)

- rG versus Warren Buffet (*ggg*)

- Walter Schloss (record)

- Retirement & Dividends

- Investitionsquote "Aktien" (Mag. R. Gollner, skizziert)

- "The Permanent Portfolio"

- Deutsche Staatsanleihen (Reale Verzinsung neg.)

- Top BrandZ 2017 - Selection from Top 100

- Cost of Capital (WACC)

- Ansparplan - langer Anlagehorizont

- Immobilienmarkt Österreich (Wien)

- XLB (US-Materials Sector)

- Bonds in a rising interest environment (History)

- Definition einer dynamischen Investitionsquote

- Well, he admits it...

- Billy Axman (Bill Ackman)

- Bonds vs. Stocks (Warren Buffet)

- Dynamische Investitionsquote (23. März 2018)

- Swimming naked...

- The period 1982 - 1999 (Kindergarden)

- 10year US-Treasuries and Dow Dividend Stocks

- Two rivals of the U.S. Stock Market

- Warren Buffet vs. Carl Icahn (2010 - Apr. 2018)

- Portfolio "German-Austrian"

- GAFAM (sehr konzentriert, Risky Risky)

- German-Austrian (Mag. R. Gollner)

- 5 US-Stocks Portfolio (High Risk, Annual Rebalancing)

- Möglicher Anlagezeitraum (30 Jahre?), Lernkurve

- Roboter und Marketing (...)

- Mission Impossible 2019 - 2028

- "German-Austrian" (Mag. Ralph Gollner) vs. DAX

- Oakmark vs. Warren Buffet vs. Danaher

- Julian Robertson ("Tiger")

- QQQ & ^Gold "Timing Portfolio"

- The Race For AI (Status: Q1-2018)

- "German-Austrian" vs. "LieberMann-Strategie"

- David "Unicorn" and some downturn...

- Asset classes / History

- Returns and Standard Deviation (1956 - 2015)

- Wiener Zinshausmarkt versus Aktien (?)

- Spin-off (Investment opportunity ?)

- Time is over: Warren Buffet (?), July 2018

- Venture Capital (magic returns?)

- US Top 10 companies

- Hanni-Börsday :-)

- David Einhorn is losing (Status: Sep. 2018)

- All we need is just a little patience...

- Piotroski F-Score (Backtest)

- Privater Zins-Tilgungsträger (2018 bis 2034)

- ETF-Cocktail (Backtest since my birthday ;-)

- Backtest of 8 US-Stocks (2002 - Sep. 2018)

- Gr8 Outperformance versus S&P 500 ('95 - 2018)

- Nachhaltige Geldanlage (2002 - Sep. 2018)

- Deutsche Anleihen(Rendite nach Inflation), 2018

- Ich baue mir (m)eine Privatpension (Jahr 2018)

- Meine Aktien-Investitionsquote (Dez. 2018)

- US-Equity Risk Premium (Dec. 2018)

- Ralph vs. Warren Buffer & Oakmark funds

- Investmentfonds-Methusalem (1934ff)

- "BASM" (Fred Kobrick)

- Stock Market Returns (U.S. stocks)

- U.S. Stock Market Returns by Decade

- Top Brandz (2018)

- Global GDP-Growth (source: OECD-Video

- Trump and the Trend-Followers (freaky stuff)

- Long-Term-Investing (20 years+)

- Bond yield versus Dividend yield

- Aktienquote in einem Portfolio (26.03.2020)

- M/eine Aktienquote (7. April 2020)

- Aktien-Investionsquote & Covid-19

- Reflation Trade (5th June 2020)

- Aktienquote per Mai 2020

- BLACK SWAN-BACKTEST (2010 bis Jänner 2020)

- LIRP-environment & Cash-yields (year 2020)

- Asset-Allocation (Crypto-Cocktail)

Articles

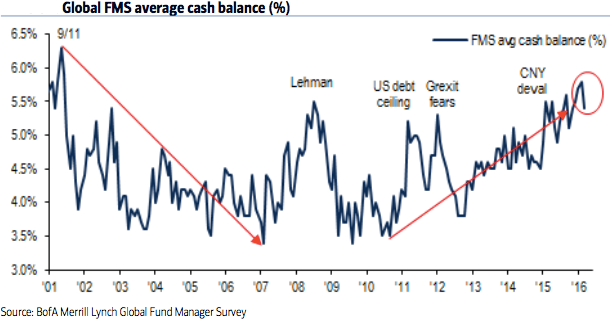

BOFA Fund Manager Survey (Aug. 2016)

Cash levels coming down from a 15-year high

Investors are still hoarding cash according to Bank of America Merrill Lynch’s survey of fund managers published 16th Aug. 2016. According to the survey, cash levels dropped to 5.4% from 5.8% last month,...

...but were still at the highest levels since 2001. An overall total of 211 participants, with assets under management of $628 billion, took part in the survey, taken Aug. 5-11, 2016.

Still, fewer fund managers are trying to hedge against a sharp fall in equity markets in the next three months. They are instead maintaining cash allocations near historic highs.

Reminder on the signal of the cash-piling: When fund managers put more than 4.5% of their holdings in cash, as has been the case for some time, it creates a contrarian buy signal, the Merrill Lynch researchers noted - in the last report from July.

link: www.digitallook.com