Related Categories

Related Articles

Articles

George Soros & Carl Icahn

Old men, but still fit (?)

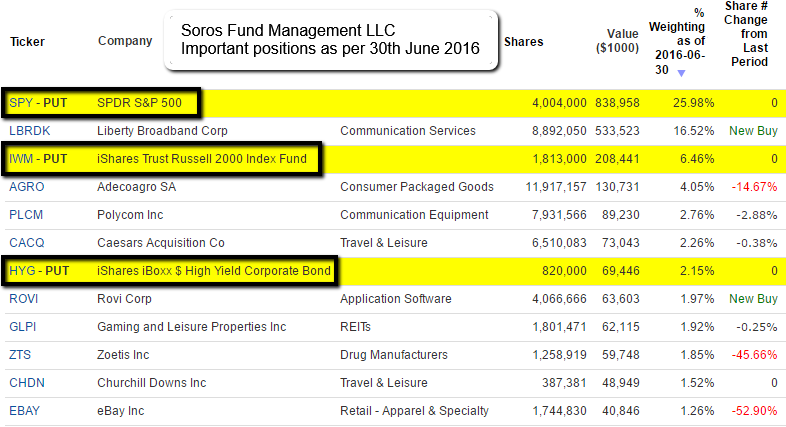

Carl Icahn turns apocalyptic: "I Am More Hedged Than Ever, A Day Of Reckoning Is Coming". George Soros: The 86-year-old’s fund disclosed in a regulatory filing it had increased its bet against the S&P 500,...

...the main index used to measure big-stock performance in the U.S., reporting "PUT" options on millions of shares as of 30th June 2016 in exchange-traded funds that tracks the indices. That"s up from "puts" on 2.1 million shares as of 31st March 2016.

Snapshot / Portfolio Holdings of George Soros at Soros Fund Management LLC (source: gurufocus.com),

This may only be a small part of his assets under management

In total according to gurufocus.com/Portfolio Date: 30th June 2016

Number of Stocks: 154

Total value: 3.23 bn USD

(from this portfolio ca. 1bn USD is invested in PUT-Options, which are mainly targeted on a downfall of the S&P 500 and the Russell 2000)

My 2 bits (Ralph Gollner): Unfortunatelly Mr. Soros hasn’t specified when those PUT-positions were placed or at what "strike" price and expiration date. If I am allowed for guessing and Mr. Soros hedged his total portfolio (more or less), then his PUT-Options might allow for a leverage of min. 3-5, so he would turn out to be equal, if the S&P 500 would RISE another 20% + - instead of falling 20%...

(My theory/on his possible strategy: In the meantime, Mr. Soros could sell parts of its portfolio ON THE WAY DOWN...)

The holdings were disclosed in a 13F filing with the Securities and Exchange Commission, a quarterly requirement for investors managing more than USD 100 million. The report indicates the number of shares held and the value of each stake at the end of the quarter.

Founded by Mr. Soros in 1969, the New York City firm manages the Soros family fortune, although much of the money is

distributed to other hedge funds and investment firms.

Carl Icahn:

Unlike other hedge fund managers, Carl Icahn does not provide monthly letters explaining his mindset which is why a lot of people eagerly watched an expansive, 40 minute interview he gave to Bloomberg's Erik Shatzker on 16th Aug. 2016, in which in addition to a detailed discussion of Trump and how the Republican presidential candidate would change the US economy, he shared some much needed insights into his gloomy vision of the market.

Below are some of the key excerpts from his discussion of the market:

Interviewer/ Mr. Shatzker: Why is it that the stock market is where it is? That with valuations so high that I noticed in the letter that - or at least in a statement that you made with your son, Bret, earlier this month, that you don't feel confident making any large investments?

Carl Icahn: Absolutely, Erik. I have hedges on, I'm more hedged than I ever was. I will tell you there's certainly good companies. [The market] is way overvalued at 20 times the S&P and I'll tell you why: a lot of it is a result of zero interest rates. It's just what I said. You have zero interest and a lot of buybacks. Money is not going into capital.

So think of it as a rich family that just decides "we're just going to have a lot of fun, we're going to sit around in the pool,

and we'll keep printing up IOUs to the town, we've got a good name." You keep doing it until you go broke. And this is what's happening in our economy. Zero interest rates are building huge bubbles. You have retirees that saved a million bucks, half a million bucks.

I think the market is at literally very high levels because of zero interest rates, and if you really look at it, the dollar is pretty strong right now, which is going to hurt international earnings. The S&P, they live on international earnings. That's going to be hurt. There's going to be a day of reckoning here. I've seen it many times in my life. When things look good, they look great. You go into the sky. But that's when you have to really pull down and really stop buying. That being said, I'm not going to tell you it's going to happen tomorrow, next week, even next month, even next year possibly. But it's going to happen, and you have to change the direction of our economy. I can't say it plainer than that."